Thinkstock

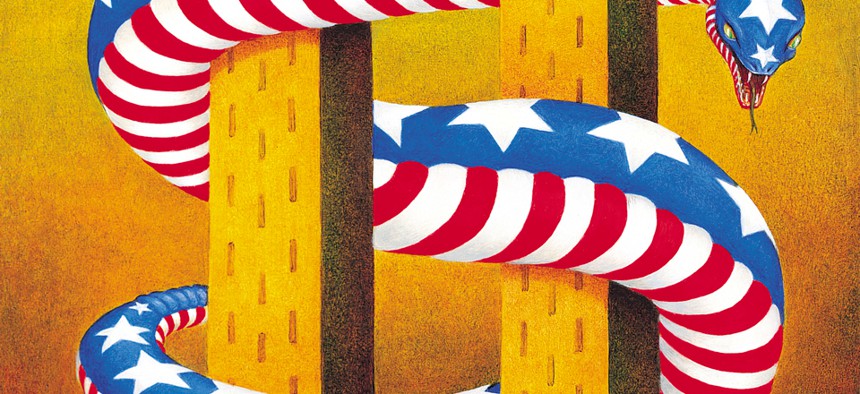

Should the IRS Outsource Collection of Tax Debt?

Congress is considering bills to require the use of private sector companies.

Federal employees should continue to collect tax debts, according to a union representing Internal Revenue Service workers, though some in Congress support contracting out the responsibility.

The National Treasury Employees Union on Monday said Uncle Sam has tried in the past to unload its tax collection duties on private business, only to have it backfire. Congress authorized the Treasury Department to contract out the task of recouping unpaid tax bills in 2006, but the agency phased out the program in 2009.

NTEU said the program proved unsuccessful, as the government was spending more on administrative fees and commissions to the companies than it took in. The Senate Finance Committee, however, recently approved an amendment to a draft tax package requiring the IRS to use private collectors. The House is considering similar legislation.

“Using private companies to collect tax debt has been tried before, resulting in millions of dollars lost to the government,” NTEU President Colleen M. Kelley said. “It was a bad idea then and it is a bad idea today.”

Sen. Chuck Grassley, who has been a consistent advocate of private tax collection and wrote a letter to then-nominee for IRS Commissioner John Koskinen to urge him to support the practice, told Government Executive the NTEU figures are in conflict with the non-partisan Joint Committee on Taxation’s estimates.

“The Treasury union always objects to using any private contractors to collect taxes, yet the IRS career employees consider the debts in question ‘low yield’ and not worth their time,” Grassley said.

The Treasury Inspector General for Tax Administration found in an August report the revenue collected by the IRS from tax enforcement has dipped 13 percent between 2010 and 2012. In that time, the IRS has shed 8,000 positions, 5,000 of which were front-line enforcement personnel.

Grassley has argued the scope of IRS’ mission has grown -- including through new responsibilities created by the 2010 Affordable Care Act -- and the answer cannot simply be “ever larger appropriations from Congress.” Instead, he said, the agency must “work smarter and utilize all the resources currently at its disposal.”

Democratic lawmakers, such as House Minority Whip Steny Hoyer, Md., and Rep. John Lewis, Ga., have said IRS employees collect taxes more efficiently than the private sector, which, they argue, is more focused on its commissions than serving the taxpayer. They have previously supported legislation to prohibit the use of tax collection companies.

Mark Schiffman, a spokesman for ACA International, the Association of Credit and Collection Professionals, noted the Education Department often uses private collectors to recoup student loans and state and local governments have increasingly turned to contracted companies to rein in debts.

When the government hires an outside collector, Schiffman said, “you’re buying that expertise,” while avoiding all the costs of training.

(Image via Jim Barber/Shutterstock.com)