There’s Now a Less Than 1 Percent Chance Your Tax Returns Will Be Audited

IRS blames budget cuts and corresponding staff decreases for a drop in audits.

The Internal Revenue Service, with 22 percent fewer agents than it had five years ago, on Tuesday reported its lowest percentage of tax returns audited in 11 years.

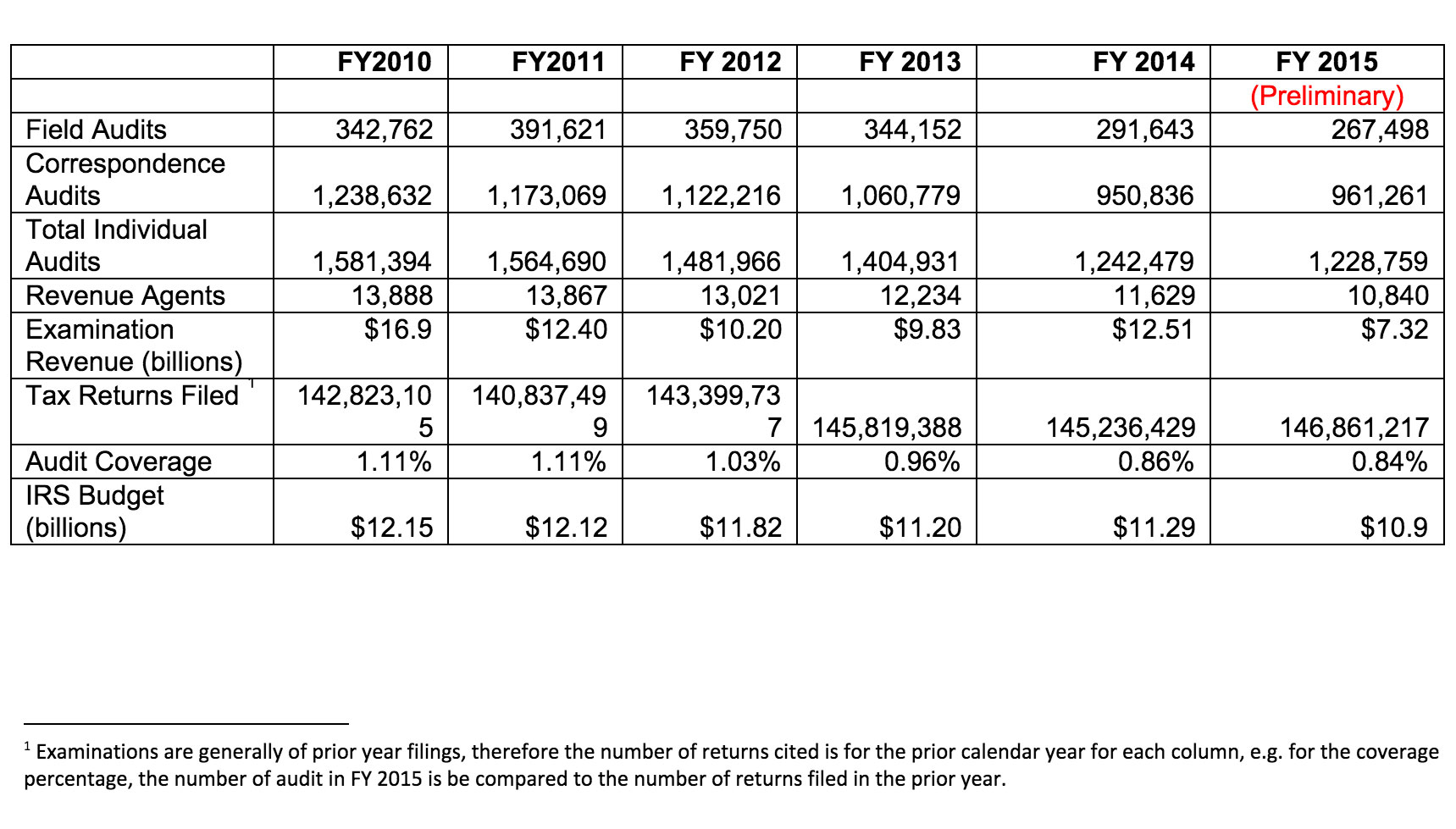

Commissioner John Koskinen told a gathering of the American Institute of Certified Public Accountants that his agency is “especially concerned about the effect that the reduction in our workforce has had on audits. The IRS completed about 1.2 million individual audits in fiscal 2015. That’s 13,700 fewer than the previous year. Even more disturbing, the decline in audits in 2015 was not a one-year aberration. The number for 2015 was 350,000 below five years ago. That’s a drop of 22 percent, and corresponds exactly to the number of revenue agents, which is also down 22 percent since 2010.”

The staff cuts of some 15,000, he continued, came as the number of income tax returns filed by individuals topped 146 million, an increase of almost 3 percent from 2010.

“Not surprisingly, we’re seeing clear evidence of a longstanding decline in revenue coming from audits,” Koskinen said in his speech. “Between 2005 and 2010, the revenue generated from audits averaged $14.7 billion annually. But since 2010, it has averaged only $10.5 billion a year, which is a drop of nearly 30 percent, and translates to more than $20 billion in uncollected revenue over the past five years.”

The percentage of individual tax returns audited to detect errors or fraud has declined steadily. “For many years, the likelihood that an individual’s return would be audited was about 1 percent,” the commissioner said, “but in 2013 it fell below 1 percent and for fiscal 2015 it fell to 0.84 percent, the lowest level since fiscal 2004.

Koskinen called the budget cuts his agency’s No. 1 problem, repeating past comments addressed to Congress about poor phone service to taxpayers and practitioners, aging computer systems and added responsibilities imposed by new laws. “There is a limit to how much we can do to find efficiencies,” he said. “In 2015, we reached the point of having to make very critical performance tradeoffs. There was simply no way around the severity of these budget cuts without taking difficult steps, which have had negative impacts on service, enforcement and information technology.”

Rep. Jim Jordan, R-Ohio, a frequent critic of the IRS who serves on the House Oversight and Government Reform Committee, on Wednesday was asked about the budget strains and said, “Maybe if the IRS had spent less time and money targeting the First Amendment rights of conservative groups around the country, then staff might have been able to better focus on doing the jobs that taxpayers actually pay them to perform.”

In an email to Government Executive, Jordan added that, “The IRS complains about having spent $14 million on the investigation into its targeting of conservatives. But this money was not used to preserve documents or clean up the department’s act. It seems to me like it was only used on efforts to obstruct our attempts to get to the truth.”

Here's a look at the IRS' recent auditing numbers: