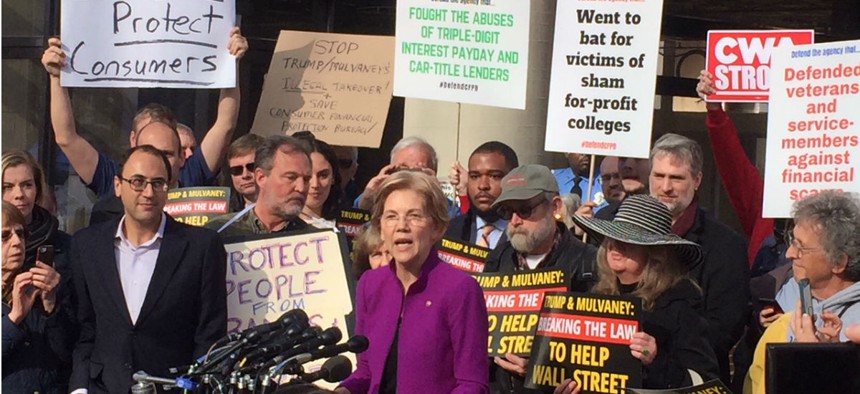

Sen. Elizabeth Warren, D-Mass., spoke to a crowd of protesters outside CFPB headquarters on Tuesday before the court ruled. Charles S. Clark/Government Executive

Court Refuses to Block Trump Appointee From Assuming Command of Consumer Bureau

Judge rejects CFPB deputy director’s request for a temporary restraining order to bar Mick Mulvaney from serving as acting director.

The drama over dueling claims for acting leadership of the Consumer Financial Protection Bureau continued on Tuesday afternoon as a district judge rejected a request from an Obama-era executive that he block White House Budget Director Mick Mulvaney from assuming control of the agency.

U.S. District Court Judge Timothy Kelly, a Trump appointee, denied the petition for a temporary restraining order from Leandra English, who assumed the role of acting director after Director Richard Cordray resigned last Friday. Kelly ruled English had failed to show she was likely to prevail in her lawsuit.

The Trump administration “applauds the court’s decision, which provides further support for the president’s rightful authority to designate Director Mulvaney as acting director of the CFPB,” said Principal Deputy Press Secretary Raj Shah in a statement. “It’s time for the Democrats to stop enabling this brazen political stunt by a rogue employee and allow Acting Director Mulvaney to continue the bureau’s smooth transition into an agency that truly serves to help consumers.”

The White House tapped Mulvaney to double as CFPB director while President Trump seeks a permanent replacement to nominate for Senate confirmation to lead an agency that many Republicans loathe and some wish to eliminate.

English’s lawyer, Deepak Gupta, told reporters after the ruling that he was weighing a possible appeal. English met today with Democratic leaders in Congress to plan strategy.

Mulvaney, who arrived at CFPB early Monday morning, immediately instructed staff to ignore directives from English and froze hiring and issuance of rules. He told reporters he planned to work three days a week at the bureau, denying speculation that he would attempt to shut it down—acknowledging he lacked the legal authority to do so.

Before the court’s ruling, some 25 current and former Democrats in the House and Senate led by Rep. Maxine Waters of California filed an amicus brief arguing that “President Trump is entitled to choose who the next director of the bureau will be, but he must nominate that person, and the Senate must agree to confirm him or her. Until that happens, the [2010 Dodd-Frank Financial Reform Act that created CFPB] makes clear who should be running the bureau: its deputy director.”

On Tuesday, Sens. Elizabeth Warren, D-Mass, and Jeff Merkley, D-Ore., spoke to a crowd of some 100 protesters in front of the bureau’s headquarters, as several CFPB employees looked on from an upper floor. “For six years, this agency has fought for working people. Now is the time to fight for this agency,” she said.

Reacting to the ruling, Richard Hunt, president and CEO of the Consumer Bankers Association, said his group looked forward to working with Mulvaney “to bring transparent and balanced consumer protections to all customers and small businesses. Many actions conducted previously by the CFPB as well as those that are pending warrant a thorough review.”

Brian Wise, president of the U.S. Consumer Coalition, who has led a campaign to restructure the CFPB, said, “this court decision is only the first step in what can be expected to be a prolonged fight between the Warren wing of the Democratic Party and the Trump administration over the future of the CFPB.”

NEXT STORY: The Agencies Cutting the Most Regulations