Veterans Affairs Department

How Hard Will New Home-Loan Limits Hit Veterans?

Congress put a limit on a popular and successful VA home loan program. Here's what that means for military home-buyers.

For the record, the 113th Congress was not the least-productive legislative body in recent history. That dubious distinction belongs to the 112th Congress (thanks, Pew Research Center ). But give the ol' 113th credit for (not) trying.

In one of its final actions, or lack thereof, the 113th Congress failed to extend a veterans' benefit that many observers describe as vital. Not even support for our troops could rally our leaders. By not acting, Congress may have affected the viability of one of the few unqualified federal success stories: the Veterans Administration home-loan guaranty program .

The VA loan program allows veterans to acquire home loans of up to $417,000 with no money down. Across much of the country, this program serves just fine: The average VA home purchase loan is for about $237,000 . But hotter housing markets call for a higher cap. That's why Congress passed a bill in 2008 enabling the VA to authorize higher loan limits (specifically, 150 percent of the loan limits set by Fannie Mae and Freddie Mac).

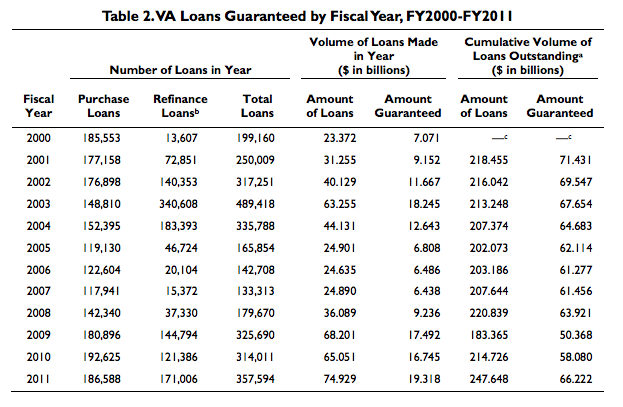

As part of the Housing and Economic Recovery Act of 2008, the provision aimed to spark a flatlining housing market by lifting the ceiling for loans with a proven track record. According to the National Association of Realtors , loans authorized through the VA home-loan guaranty program "perform better than any other loan product on the market." The trick worked, for its part: While VA refinancing loans dipped during the recession, purchase loans remained steady.

Congressional Research Service

In recent years, those VA guaranty home loans have increased in number to their highest levels since 2000. Yet despite the program's success, the provision is set to expire on January 1, 2015. The recently passed #CRomnibus did not extend the 2008 provision—meaning that in high-cost housing markets, veterans and active-duty military may not be able to acquire a home loan without providing some level of down payment.

So how badly did Congress mess up? That depends on whom you ask. U.S. Coast Guard Master CPO Vincent W. Patton III (ret.) penned an editorial for The Hill explaining that excluding eligible military members who live in pricier markets is bad for both those homebuyers and those markets:

The program’s excellent performance over the years, even at the height of the home mortgage crisis, can be directly attributed to more thorough underwriting and proactive customer services. The VA has made a commitment to helping Veterans not just purchase homes but keep them. If the rest of the U.S. mortgage market had followed the risk-control measures of this program, the country would have experienced far fewer economic problems.

The National Association of Realtors urged Congress not to let the provision expire. Chris Birk, who wrote the book on VA loans—it is literally called The Book on VA Loans —explains what the provision's sunset means for buyers in some of those high-cost areas. According to Birk , a $680,000 three-bedroom home in Montgomery County, Maryland, that cost a qualified military borrower no money down in 2014 would cost the same buyer more than $13,000 to close in 2015.

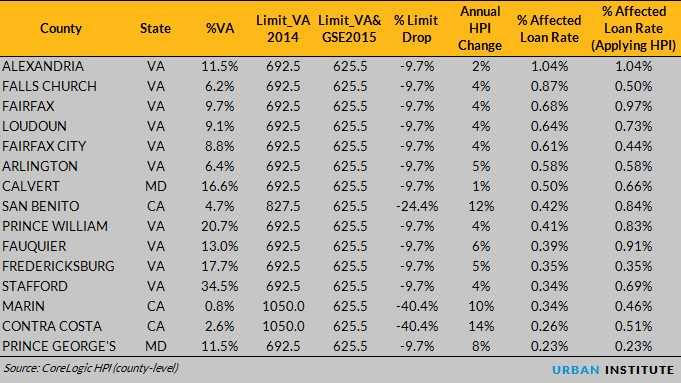

Yet Laurie Goodman and Jun Zhu, researchers at the Urban Institute's Housing Finance Policy Center, have released a study that says the new, shorter ceiling for the VA home-loan guaranty program will have little effect on veterans. Yes, the new limit will reduce VA loan amounts by as much as 40 percent in some areas, the researchers acknowledge. And of the 82 counties affected under the new dispensation, D.C. suburbs will be hit especially hard. Loan limits in New York City will fall by 36.1 percent.

Still, large numbers of veterans won't lose access to credit. Using 2013 data from the Home Mortgage Disclosure Act, Goodman and Zhu calculated the total number of VA-guaranteed loans in the counties were the limit will fall. They also figured out the number of 2013 loans that would fall within the 2014 limit but would exceed the new 2015 limit—the home-loan gap, as it were.

This research shows that very few military homebuyers will be affected at all.

Urban Institute

Alexandria County in Virginia is the county affected the most by the rules change (owing to the large number of active-duty military personnel living in the D.C. area). There, 11.5 percent of loans originated in 2013 were VA mortgages: quite a lot. But only 9 percent of these loans fell in the gap (over the 2015 limit of $625,000 but under the 2014 limit of $692,500). So, according to Goodman and Zhu, just 67 of the 6,396 VA loans originated in 2013 be affected by the new limit: about 1 percent.

"While the effect of the loan-limit change is small nationwide, it could potentially have a more noticeable impact in communities where veterans are concentrated, and where the cost of homes is relatively high," the researchers write. "Virginia is the prime example of this; but even there, the effect is very modest."

That's not to say that the sunset on the bill represents good housing policy. Maybe the fact that so few buyers will be affected goes to show what USCG Master Patton III says about the program: The risk-control measures ensure that military borrowers buy homes within their means (and keep them). So I wouldn't congratulate Congress on deciding not to renew the provision just yet: After all, while the new limit may keep very few military homebuyers from buying a home, that's still some. And it could push others toward buying homes or mortgages that don't suit their needs.

The continuing resolution–omnibus spending bill passed earlier this month does include many benefits for veterans, especially homeless and at-risk veterans . (No wonder, in the wake of the VA hospitals scandal .) Still, Congress tightened up an economic-stimulus program that has put veterans in homes and resulted in fewer delinquencies or defaults than any other kind of loan out there. Maybe it hurts few people. But who does it help?