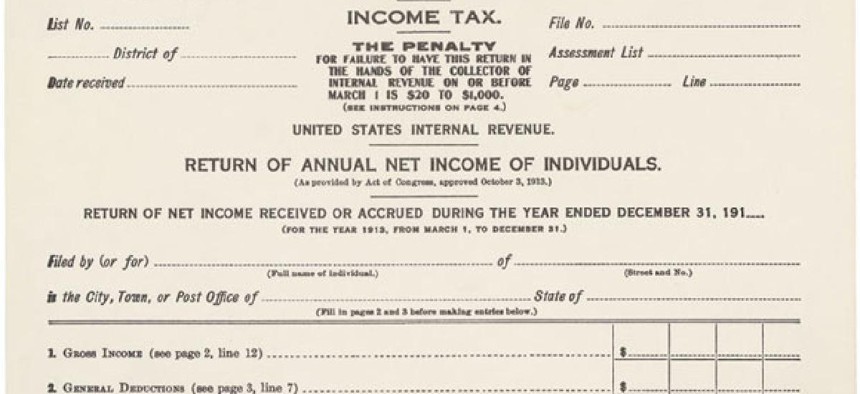

National Archives

The Income Tax Form Turns 100

The 16th amendment to the Constitution went into effect in 1913.

There is probably no single number more closely associated with tax day than 1040, the number assigned to the federal income tax form. This year, that form turns 100.

On Feb. 3, 1913, Wyoming ratified the 16th amendment to the Constitution, authorizing Congress to tax income. That move gave the one-sentence measure approval from three-fourths of the states, the threshold needed to amend the Constitution.

Later that year, the Bureau of Internal Revenue issued the first-ever Form 1040, the federal income tax form. At the time, there were only two tax rates: a 1 percent tax on income above $3,000 and a 6 percent tax on income above $500,000. But few people paid it, according to the National Archives, which hosts a digital version of the original form.

"[D]ue to generous exemptions and deductions, less than 1 percent of the population paid income taxes at the rate," the Archives explains.

And it wasn't the first time that Congress had levied an income tax. Here's some history from the Internal Revenue Service, which took on that new name in the 1950s:

nbsp;

The roots of IRS go back to the Civil War when President Lincoln and Congress, in 1862, created the position of commissioner of Internal Revenue and enacted an income tax to pay war expenses. The income tax was repealed 10 years later. Congress revived the income tax in 1894, but the Supreme Court ruled it unconstitutional the following year.

The tax code has undergone many changes since and could be reformed once again, with the White House and the heads of the congressional tax-writing committees on board for comprehensive reform. But one thing hasn't changed: the number on the form for individual filers.

The IRS hosts a digitized version of that first-ever 1040 form, while the National Archives hosts a copy of the original.

NEXT STORY: Obama Budget Renews Effort to Cap Contractor Pay