smutny pan/Shutterstock.com

The Incredible Shrinking Incomes of Young Americans

You can't explain millennial economic behavior without explaining that wages have collapsed.

American families are grappling with stagnant wage growth, as the costs of health care, education, and housing continue to climb . But for many of America's younger workers, "stagnant" wages shouldn't sound so bad. In fact, they might sound like a massive raise.

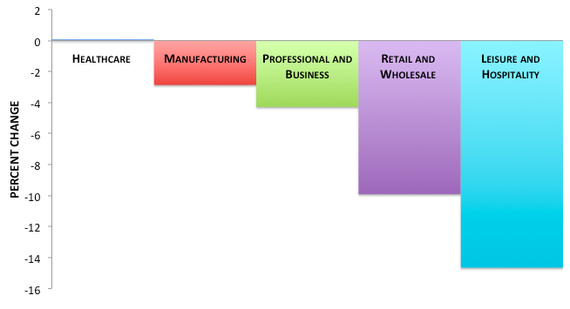

Young People's Wages Have Fallen Across Industries Between 2007 and 2013

These numbers come from an analysis of the Census Current Population Survey by Konrad Mugglestone, an economist with Young Invincibles .

In retail, wholesale, leisure, and hospitality—which together employ more than one quarter of this age group—real wages have fallen more than 10 percent since 2007. To be clear, this doesn't mean that most of this cohort are seeing their pay slashed, year after year. Instead it suggests that wage growth is failing to keep up with inflation, and that, as twentysomethings pass into their thirties, they are earning less than their older peers did before the recession.

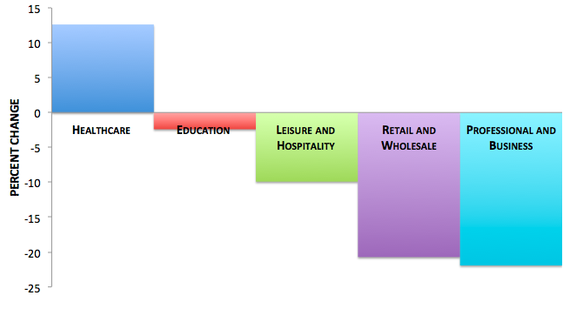

The picture isn't much better for the youngest group of workers between 18 and 24. Besides health care, the industries employing the vast majority of part-time students and recent graduates are also watching wages fall behind inflation. (40 percent of this group is enrolled in college.)

The Wages of the Youngest Workers (Ages 18-24) Have Fallen, Too

There are a few reasonable follow-up questions to these stunning graphs.

First: Why are real wages falling across so many fields for young workers? The Great Recession devastated demand for hotels, amusement parks, and many restaurants, which explains the collapse in pay across those industries. As the ranks of young unemployed and underemployed Millennials pile up, companies around the country know they can attract applicants without raising starter wages.

But there's something deeper, too. The familiar bash brothers of globalization and technology (particularly information technology) have conspired to gut middle-class jobs by sending work abroad or replacing it with automation and software. A 2013 study by David Autor, David Dorn, and Gordon Hanson found that although the computerization of certain tasks hasn't reduced employment, it has reduced the number of decent-paying, routine-heavy jobs. Cheaper jobs have replaced them, and overall pay has declined.

Your second question might be: Why have health-care wages been the exception to the rule? One answer is that health care is, generally speaking, the exception to many rules. Demand for medical services is dominated by the government (i.e. Medicare, Medicaid, and the employer insurance tax break), which doesn't face the same vertiginous up-and-downs as the rest of the economy. So as the Great Recession steamrolled many industries, health care, propped up by sturdy government spending, kept adding workers. What's more, computerization and information technology have yet to work their magical price-cutting power in health care as they have in other industries, for a variety of reasons . Americans are spending four percent less on food away from home than in 2007; but we're spending 42 percent more on health insurance . As prices have increased, so have wages for younger workers in the medical field. ( Update : Some readers have made the smart suggestion that money which might have gone to higher salaries has instead gone to paying higher health insurance costs.)

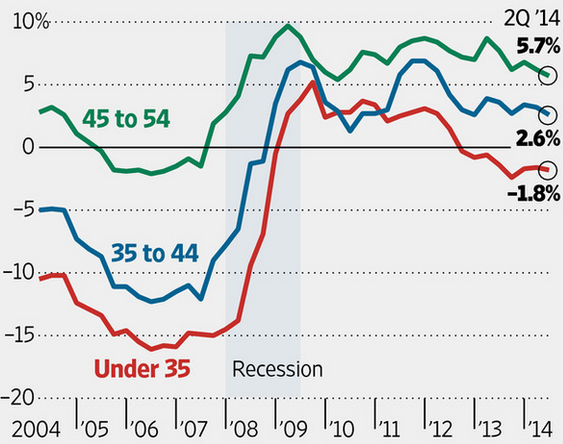

Once you account for falling wages among young workers—if you must: "the Millennials"—many mysteries of the economic behavior of young people cease to be mysterious, such as this generation's aversion to home-buying, auto loans , and savings . Indeed, the savings rate for Americans under 35, having briefly breached after the Great Recession, dove back underwater and now swims at negative-1.8 percent.

Savings Rates Since 2004, by Age

Some of these young people could afford to save more , even if it's a small share of their meager income, since small amounts of money put away several decades before retirement (or an unexpected emergency) can help later. But it's easier to see why young Americans aren't saving any more than we used to: Their wages are falling behind the cost of basic goods and many are going into debt to pay for a college degree.

The evaporation of real wages for young Americans is a real mystery because it's coinciding with what is otherwise a real recovery. The economy has been growing steadily since 2009. We're adding 200,000 jobs a month in 2014. That's what a recovery looks like. And yet, overall U.S. wages are barely growing, and wages for young people are growing 60 percent more slowly than overall U.S. wages. How is a generation supposed to build a future on that?

( Image via smutny pan / Shutterstock.com )

NEXT STORY: The Wasted Workday