Obama meets with civil rights leaders in 2014. Pete Souza/White House file photo

Report: Federal Government is Effectively Fighting Inequality

Inequality is growing. But so are government efforts to combat it—and they’re working.

A new report from the Congressional Budget Office on household income since 1979 reaches two stark and significant conclusions. Inequality is growing. But so are government efforts to combat it—and they’re working.

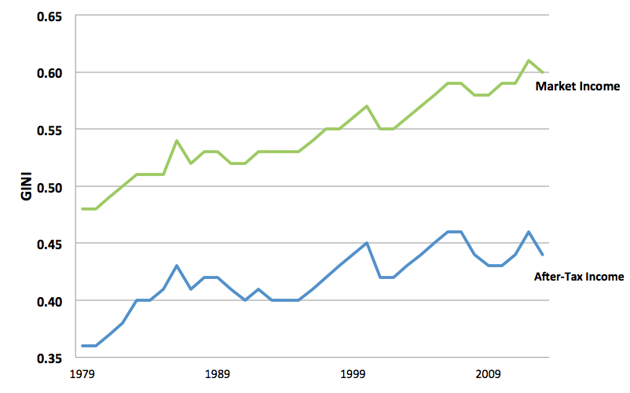

First, the bad news. The distribution of income in the United States has been more unequal under Obama’s presidency than any time since the 1930s, according to the Gini Index, a conventional measure of the inequality. What’s going on here?

It really is a story of the 1 percent and the rest. Look at how market income grew between 1979 and 2013 for the poor (lowest quintile), the broad middle class (middle three quintiles), the fairly rich (81st-99th percentiles), and the truly rich (the top 1 percent). What’s really driving inequality isn’t really the scrum among the “bottom 99.” It’s the 1 percent sprinting away from the rest.

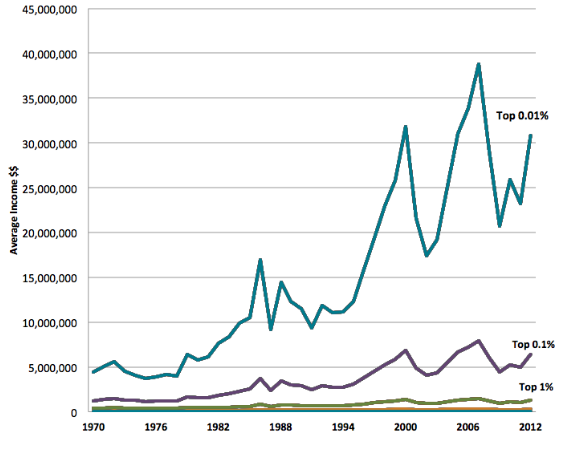

That may look pretty dramatic, but the gap between the 1 percent and the rest is tiny compared to the inequality within the 1 percent. Between 1979 and 2012, the top 0.01 percent—the 1 percent of the 1 percent—saw its income sextuple, according to analysis from the World Wealth and Income Database, growing more than twice as fast as the entire top percentile.

The Growth of Average Incomes Within the 1 Percent

There are several reasons for rise of the 1 percent of the 1 percent, including the growing share of the economy going to finance and real estate and rising pay gaps both within companies (CEOs earning more than their workers) and between companies (all Apple employees earning more than other workers). But the result is that inequality is fractal: The gap between the 0.01 percent and “the rest of the 1 percent” is just as dramatic, if not more so, than the gap between the 1 percent and the rest of the country.

But while the economy’s reward system has never been more skewed toward the tippy top, a different measure of inequality shows a less dramatic story. “After-tax income”—which includes government help (like Social Security checks) and government levies (like Social Security taxes)—is more equal than it was in the late 1990s or the mid-2000s.

Growth of Inequality Since 1979, Measured by Gini Index

(0.00 Equals Perfect Equality)

After-tax income is a better measure of inequality for two reasons. First, it more accurately reflects the disposable income of families. Second, it reflects the serious efforts of any government—in this case, the Obama White House, Congress, former administrations, and state and local governments—to fight inequality. In 2013, President Obama signed a law to avert the fiscal cliff that raised taxes on income, long-term capital gains, dividends, and estates. It was the largest tax increase in 20 years, and the average federal tax rate on the 1 percent are now at their highest level since the mid-1990s. What’s more, the administration also increased benefits. For example, the the Affordable Care Act expanded Medicaid coverage.

The upshot is that the federal government is doing more to correct inequality right now than at any time in the last 35 years. The five years when tax and transfer policies took the biggest bite out of inequality were the first five years of Obama's presidency.

Historically, the United States has had worse inequality than most countries for two major reasons. The first culprit is the economy itself: U.S. labor markets have a large pool of low-wage workers and a uniquely rich top percentile, widening pre-tax inequality. The second culprit is U.S. culture, reflected in its government’s policies, which tolerates much higher inequality than its European peers.

Market inequality—the rewards of the economy before tax and transfers—is surprisingly about the same in the U.S. as in Ireland and the U.K. But those countries are much more aggressive about taxing income and transferring that money from the rich to the poor in the form of cash or benefits. As a result, the U.S. has the single highest after-tax inequality in the OECD,because its voters, policymakers, and elites tolerate inequality and even (if they’re running for the Republican nomination) compete with each other to exacerbate it.

The gap between the 1 percent and the rest is growing all over the world, and identifying its many causes is a difficult and ongoing challenge in economics. Some might say that the Obama administration should be doing more to fight inequality before the tax man gets his cut, by working to raise the minimum wage, strengthen labor laws, and regulate the financial sector.

But the White House’s success in tamping down after-tax inequality with taxes and transfers suggests that the a sure step toward fighting the forces of global inequality might not require much more than some simple bit of arithmetic: less for the very rich, more for the rest.