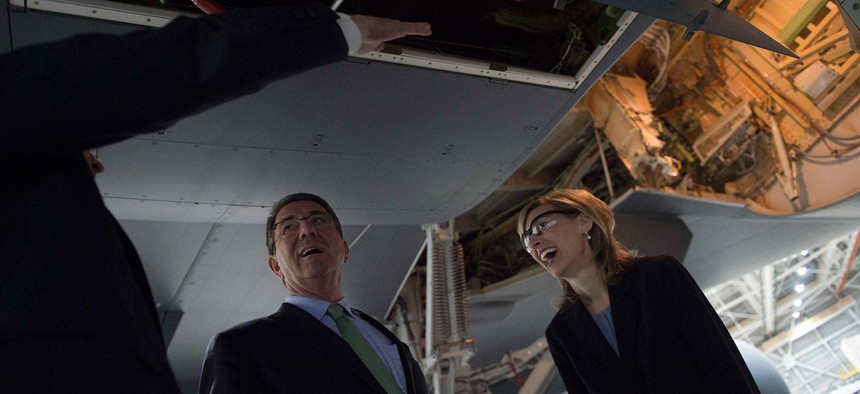

Boeing Defense CEO Leanne Caret gives Defense Secretary Ash Carter a tour of a Boeing KC-46 at at the Boeing facilities in Seattle on March 3, 2016. Navy Petty Officer 1st Class Tim D. Godbee/ Defense Department

The Future of Boeing Defense, According to Its New CEO

Five areas that Leanne Caret wants to focus on — and a few things she wants to stop doing.

FARNBOROUGH, England — Leanne Caret, the new chief executive of Boeing’s $30 billion defense unit, wants people to quit agonizing over contracts the firm has lost, stop calling current competitions “must-wins,” and start focusing on growing business.

“There are clearly priorities for me that we want to win,” said Caret, who took over Boeing Defense, Space & Security in February after the abrupt departure of Chris Chadwick. “But I try to stay away from the words [must win] because it sends part of that message where we create this vision that this company can only do certain things.”

Instead, Caret said, she has “can-wins.” Three U.S. Air Force projects top the list: a new pilot training jet, a new radar plane to track lots of objects on the ground, and new intercontinental ballistic missiles.

More broadly, she said, “I specifically want us to be leading in … the commercial derivatives, the satellites, like human space exploration, military rotorcraft, [autonomy], and for services.”

Caret came to Farnborough, along with other top executives from around the globe, for the biennial air show that is one of the world’s largest aerospace and defense events. Sitting in Boeing’s corporate chalet, overlooking dozens of military and commercial airplanes on the flight line of the Farnborough Air Show, she displayed the bubbly-but-serious attitude she’s bringing into a business sector dominated by dry personalities. She gets visibly excited when talking about Boeing and the projects she’s worked on during her 28 years with the company.

In an interview, Caret mixed thoughts on high-level strategy with intricate details about some of the firm’s projects. The E-4B mobile command center, she noted, can connect in flight to old teletype machines and the newest computer networks.

She cautioned against viewing any particular contract as critical to Boeing’s future. Take the fighter-jet business. After the company lost the Joint Strike Fighter contest to Lockheed Martin, some analysts declared that the Air Force’s $80 billion long-range stealth bomber program had become a must-win for Boeing. American orders for the F-15 Eagle and F/A-18 Super Hornet are nearing completion, and Boeing is still waiting for the White House to approve jet fighter sales to Kuwait and Qatar. Losing the bomber program to Northrop Grumman, the analysts said, spelled doom for the St. Louis assembly lines that have built F-15 Eagles and F/A-18 Super Hornets for decades.

Caret disagreed.

“I feel very optimistic that we'll be continuing production well into the 2020s,” she said.

Conceding that there is little reason to expect many new sales of these planes, she said she is focused on securing contracts to overhaul the U.S. Navy’s 500-plus Super Hornets, extending their flying lives by more than 3,000 hours, and modifying them to more easily accommodate future upgrades.

The cost of maintaining and upgrading fighter jets over decades of use is typically roughly double their original purchase price.

“It's a great business and it’s one where I can really use our engineering talent and to keep it current and to continue to look at how we do those technical insertions that continue to differentiate these aircraft in the future,” she said.

Caret talked up Boeing’s new partnerships with companies more often seen as rivals. With Swedish manufacturer Saab, for example, Boeing will design a plane to compete for the Air Force’s T-X pilot trainer program. Her firm is also working with Lockheed Martin’s Sikorsky to design a futuristic helicopter for the Army.

“We are in an industry where I like to use the word ‘cooper-tition,’” Caret said. “We cooperate and we compete and we have leaders who understand that you have to be able to do both. You can learn a lot [from] folks just like they can learn a lot from us and I think it brings [the] best of teams together.”

Looking to the future, the Pentagon wants its arms and technology faster and more flexible. For Boeing, the key is adapting commercial technology every more cheaply and quickly. The company has long sold militarized versions of its jetliners — like the E-8 JSTARS radar plane, based on the 707, or even the 747-based Air Force One. Today, the Air Force is buying refueling tankers based on the 767 and the Navy P-8 submarine-hunting plane based on the 737.

Now it is pitching 737-based designs to replace the JSTARS and other intelligence aircraft. In some of these competitions, the 737 will likely go up against smaller, fuel-sipping business jets, like the ones the Air Force is reportedly considering to replace the EC-130 electronic attack plane.

But size, Caret said, has its advantages.

“Not every mission is going to be identical in terms of what they need, but one thing [that] is traditionally true is size, weight and power always come down to be the basic conversation pieces,” she said. “There’s a certain mission set where I believe having the 737 provides a distinct advantage for that customer in terms of current mission ops as well as future growth potential, and we’ll compete on each of those as they come to the table.”

Space exploration is also high on Caret’s priorities list.

“I intend to remain No. 1 in that market space,” she said. “But we recognize that we’re at a juncture where the next disruption in that space is going to be more than about price. It's going to be about price integrated with safe reliable and assured travel.”

NEXT STORY: When Solid Data Isn’t Enough