Pay & Benefits

OPM to Propose Expanding Dental and Vision Benefits to More Federal Workers

In a new proposed rule, OPM would extend eligibility to temporary and part-time workers, as well as federal firefighters and other “intermittent” first responders.

Pay & Benefits

Open Season To-Do List

Don’t let health insurance decisions and deadlines sneak up on you.

Pay & Benefits

Annual Employee Viewpoint Survey Coming Next Month, and More

A weekly roundup of pay and benefits news.

Pay & Benefits

Federal Retirees to See Largest Cost-of-Living Adjustment in Decades in 2022

While CSRS retirees will receive a 5.9% boost to their defined benefit annuity payments next year, enrollees in FERS will only see a 4.9% increase, renewing calls to change the law.

Pay & Benefits

Bill to Provide Paid Family Leave for Feds Could Cost $20 Billion By 2027

Officials with the Congressional Budget Office warned that the actual price tag of providing feds with up to 12 weeks of paid family leave could vary widely from their estimate, depending on how much the new benefit is used.

Pay & Benefits

Open Season Shopping Tips

It’s not too soon to start thinking about your health insurance options.

Pay & Benefits

Biden Administration Makes Student Loan Forgiveness Program Easier to Use

A weekly roundup of pay and benefits news.

Pay & Benefits

TSP Portfolios Fall for First Time Since January

After an extended period of steady growth, nearly every fund in the federal government’s 401(k)-style retirement savings program ended September in the red.

Pay & Benefits

The New Health Insurance Rates Can Only Mean One Thing

Open season is around the corner.

Pay & Benefits

Employee Groups React to Health Insurance Open Season Announcement

A weekly roundup of pay and benefits news.

Pay & Benefits

Feds Will Pay 3.8% More Toward Health Care Premiums Next Year

Cost growth stems largely from specialty drugs, treatments for chronic illnesses and the COVID-19 pandemic, insurers said, although federal workers will be impacted less than employees of other large organizations.

Pay & Benefits

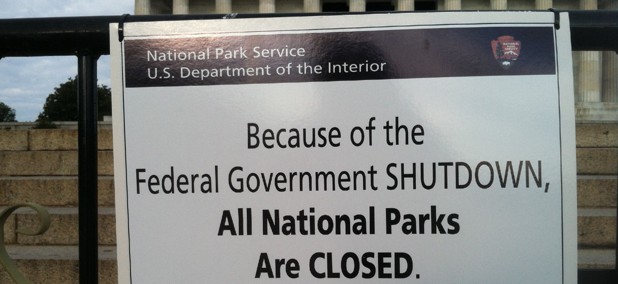

Biden Administration Appears to Take a Furlough Approach Similar to Trump's as Shutdown Nears

The White House has yet to say if it will employ the same drastic tactics to keep some agencies fully operational during a funding lapse.

Pay & Benefits

Best Dates to Retire 2022

The annual calendar showing optimal days to move on from government.

Pay & Benefits

What Federal Employees Should Know About Their Pay If There Is a Shutdown at the End of This Month

Unlike previous closures, furloughed workers would be guaranteed retroactive compensation once government reopens.

Pay & Benefits

Four Rules for Picking a Retirement Date

A guide to deciding exactly when to move on.

Pay & Benefits

What's Known So Far About the Vaccine Mandate for Feds, and More

A weekly roundup of pay and benefits news.

Pay & Benefits

Career Prosecutors Continue Push for Pay Equity

According to Justice Department statistics, only 65% of assistant U.S. attorneys are paid equivalent to a GS-15 or above, while the attorney corps at several other subcomponents are over 90% GS-15s.

Pay & Benefits

OPM Adds Tribal School Workers to FEHBP, and More

A weekly roundup of pay and benefits news.

Pay & Benefits