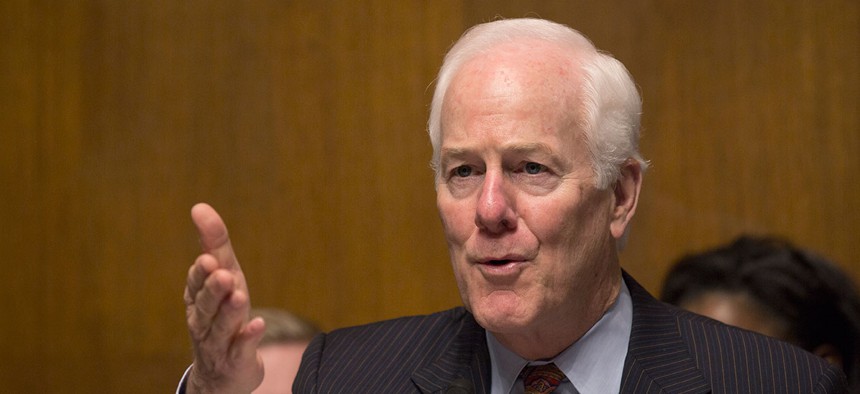

Sen. John Cornyn, R-Texas, wants to make it harder for the Chinese to invest in U.S. technology development, including in companies developing artificial intelligence. Glenn Fawcett/ Customs and Border Protection

How Not to Win an AI Arms Race With China

A lawmaker’s proposal to curb Chinese investment in U.S. artificial-intelligence firms has more than a few critics.

The idea of a Chinese-U.S. arms race for artificial intelligence conjures up images of an army of swarmbots defeating self-driving tanks on a smoldering, depopulated hellscape. It’s an idea so captivating that Sen. John Cornyn, R-Texas, wants to make it harder for the Chinese to invest in U.S. technology development, including in companies developing artificial intelligence, out of fear that Beijing will use small investment positions in Silicon Valley firms to erode U.S. national security and technological advantage. But tech entrepreneurs, academics in the field, and former senior officials in the White House and Pentagon think the proposal would do more harm than good.

Cornyn pitched his idea at a Council on Foreign Relations event on Thursday, citing a 2016 Defense Department report that explored how various Chinese investment activities might affect U.S. national security. The report, produced under former Defense Secretary Ash Carter and sometimes referred to as “the DIUx paper,” is not classified but has not been made available to the public. (Defense One has submitted a Freedom of Information Act request to obtain it.)

Cornyn said the report found that "China is aggressively investing in future technologies that will be foundational to future innovations across technology that will have commercial and military applications,” including AI in particular.

The senator has dubbed his proposed remedy the Foreign Investment Risk Review Modernization Act. It would allow the Committee on Foreign Investment in the United States, or CFIUS, to let the Treasury Department, working with other agencies, scrutinize and possibly unwind tech deals that involve countries on a special Defense Department list. Cornyn said Treasury Secretary Steven Mnuchin supports the idea, broadly.

A former senior Pentagon official who had also seen the report offered a rather different view of it. Sure, the report found that “there was significantly more investment in those areas [like artificial intelligence] than in others.” But that fact alone “was not that strange,” the official said.

Furthermore, “the idea that CFIUS is going to be able to look intelligently on what investments the Chinese should be able to make in Silicon Valley firms is probably not a great idea,” he said. “I’m super-skeptical of CFIUS being effective for that.”

Moreover, it is neither new nor surprising that Chinese investors are attracted to start-ups focusing on artificial intelligence.

“Almost every early-stage Chinese fund coming [to Silicon Valley] is heavily, heavily into AI,” says Rui Ma, an independent angel investor who has helped Chinese firms invest in U.S. tech.

Rui said Cornyn’s proposal caught many Chinese investors by surprise. "Almost every early-stage Chinese fund coming to [the United States] I’ve talked to is not aware of any political implications of their money,” she said.

Chinese investors are relatively new to Silicon Valley and "are not typically sought after for the largest chunks [or] leads in the best deals, currently,” she said. The effect of pushing them out of the start-up market might not have a large effect on the funding stream.

Entrepreneur Sean Gourley echoed this. “Given that there is already a large amount of capital available to good companies, the extra Chinese capital hasn't changed too much,” he said.

But that could change in a few years. At some point, Cornyn’s law could hurt startup’s ability to raise funds.

Key venture funds with a foot in both China and the U.S. — including Danhau Capital, Seven Seas Partners, Hemi Ventures and GSR Ventures — all have positions in AI startups.

The question is, will thwarting Chinese investment in American start-ups improve U.S. national security or secure U.S. technological dominance in artificial intelligence in the next 20 years? A former Senior White House official, as well as academics who spoke to Defense One, were highly skeptical and said that the proposal, as they understood it, represented a fundamental misunderstanding about the state of AI research and its potential.

This is Not the Droid Problem You’re Looking For

Artificial intelligence will have a huge impact on the military in the next 10 years — well beyond drones, according to one former senior White House official who was instrumental in crafting the Obama administration’s technology policy and guidance reports. The biggest game-changer for the military is “not going to be the sexy weapon systems. It’s going to be logistics and supply chain optimization. That’s where there will be massive efficiency gains. Just like in industry,” he said.

This is not to say that surrendering competitive advantage in artificial intelligence to the Chinese, or any other nation, does not carry serious national security risks. But, said the official, those risks reflect how the Chinese might use artificial intelligence within key areas — not in the formulas, tools, or early-stage investment they build or acquire.

“The places I get more concerned about,” he said, are “what happens particularly around health care when healthcare combines with AI, and what happens around cybersecurity.”

Managing those two risks, as well as others that emerge from the applications of AI, means better identifying relevant data sets that would feed AI programs or machine learning algorithms, several researchers said.

Restricting Chinese money into early-stage startups would have “literally zero impact” on that, according to the official.

The former Pentagon official was even more pessimistic about stifling Chinese investment in early-stage start-ups. “You can hurt Silicon Valley by trying to put a very DC-centric model on [venture capital.] I think it’s something we need to watch out for.”

Cornyn acknowledged that industry representatives he had spoken to were “skeptical” of the measure.

One prominent Silicon Valley AI researcher and entrepreneur who had worked closely with top technology companies in both the United States and China said Cornyn’s measure “will only hurt US AI efforts by restricting foreign investments and therefore bringing less capital and know-how to [the] US AI community. China's AI efforts are already very advanced.”

The U.S. technological dominance in AI is, indeed, in danger. But dominance in AI takes the form of people, expertise and capital rather than specific AI programs or even companies, said officials, entrepreneurs, and researchers. While it’s possible to restrict the sale of a port, a piece of physical infrastructure, or nuclear material, these kinds of covetous measures work less well against a formula, method, or intellectual breakthrough, which are far more exportable.

Another inexorable trend that legislation dealing with startup funding can’t address: Chinese academic expertise in AI is growing far faster than their foreign direct investment. Chinese attendance at February’s Association for the Advancement of Artificial Intelligence conference, considered by many the field’s premier academic conference in the field, was up 72 percent from the previous year.

While the U.S. had the most attendees, China was close behind. Chinese students also produced the second-highest number of accepted papers at the conference — 172, just behind the 189 U.S. papers.

“Limiting Chinese investment in AI startups will lead to more money staying in China. There are many American-educated Chinese nationals that would take jobs in China if the opportunities were comparable to those in the United States,” said Sean McGregor, who recently earned a Ph.D. in AI from Oregon State University.

“They want to stay in Silicon Valley,” the former Pentagon official said of Chinese students studying artificial intelligence. “If you really wanted to buck up the U.S. in AI, just attach a green card to every new Ph.D.”

NEXT STORY: Trump: There Are (Probably) No Tapes