Management

A Management Agenda for 2025 and beyond: Pivoting from outcomes to results

COMMENTARY | When it comes to creating a government that solves the country’s big problems, the people just don’t believe it’s happening. Here’s how to fix that.

Oversight

IRS is behind on Biden policy to not increase audits for households under $400K

TIGTA reports that the IRS has not developed a methodology to comply with a 2022 directive that bars IRA funding from being used to increase audits on households earning $400,000 or less annually.

Tech

IRS is flying blind without plans to modernize legacy tech, watchdog says

This isn’t the first time the IRS has been called out by oversight officials for a lack of detailed technology planning.

Oversight

IRS program to assist poor taxpayers rarely picks up the phone

TIGTA investigators were unable to leave a message at 16 local Taxpayer Advocate Service offices because their voicemail boxes were full.

Tech

Treasury’s funding request for IRS cloud tech far outpaces other civilian agencies, report says

Treasury’s request is the largest out of a combined federal civilian total of almost $9 billion for cloud-related programs in their fiscal year 2025 IT budget requests.

Oversight

IRS services for underserved taxpayers are good but can be better, report says

While the IRS has focused on improving customer service for underserved taxpayers, TIGTA noted that the tax agency doesn’t currently have a definition for such taxpayers.

Oversight

Tax audits for some millionaires may be more effective than targeting a wider range, report finds

The TIGTA report compared a 2020 IRS directive that required annual audits on some individuals making more than $10 million to a wider income range, finding that the former yielded more assessments.

Tech

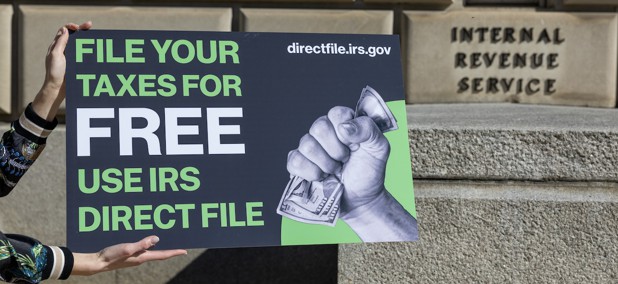

What it will take to make Direct File permanent

The IRS will have to grapple with expanding access and capabilities — while also convincing skeptical lawmakers to maintain funding.

Oversight

IRS is reducing its physical footprint but needs a better long-term plan, its IG says

The IRS has reduced its office space by 2 million square feet since fiscal 2018, but the watchdog said it could save millions in real estate costs with additional steps.

Tech

IRS makes Direct File permanent

The tool piloted during the recent tax season helped certain taxpayers file online with the government for free.

Workforce

IRS wants tax training focused on big filers

The agency seeks better training and access to tax law expertise regarding large organizations and wealthy individuals.

Management

IRS chief pleads for another funding boost to skeptical lawmakers

Commissioner says recent successful tax season is unsustainable without more cash to sustain resources.

Workforce

IRS says layoffs possibly by 2026 without sustained funding boost

The tax agency plans to grow its workforce another 14% in the coming years, but such growth could prove unsustainable.

Tech

IRS considers the future of its Direct File pilot

The agency hasn’t decided if it’ll field the program long term but does say that user feedback of the tool has largely been positive.

Management

Bipartisan group looks to push IRS towards simpler math error notices

The IRS MATH Act would require the tax agency to send more specific, straightforward notices when it corrects simple math errors on tax returns.

Management

IRS commissioner indicates AI will play growing role in future tax collection

IRS Commissioner Danny Werfel opined about the agency’s current and future use of AI just days after Tax Day.

Tech

100,000 have used IRS Direct File to submit their tax returns

The agency has not yet determined whether the pilot program for the tool will be extended into a permanent offering.

Management

Taxes are due even if you object to government policies or doubt the validity of the 16th Amendment’s ratification

The IRS "has stated repeatedly that a taxpayer does not have the right to refuse to pay taxes based on religious or moral beliefs."

Tech

The IRS is testing a free method to directly file taxes. But not everyone is thrilled

The IRS estimates that 19 million taxpayers are eligible to use the new program in advance of the April 15 tax filing deadline.

Oversight