Surfing the

Retirement Wave

A Candid Survey on Federal Retirement Preparedness

Approximately 10,000 baby boomers are reaching retirement age per day, and an increasing number of federal employees are preparing themselves both financially and mentally for the next phase of their lives. However, today’s workforce faces a host of considerations and challenges in laying the groundwork for a smooth and secure retirement.

To better understand the current state of workforce retirement preparedness, Government Business Council (GBC) conducted an in-depth research study of federal employees. Overall, the results indicate that while federal employees have considered the broader elements of retirement planning, they have yet to fully prepare for this major life transition.

Research Methodology

Government Business Council released a survey on federal retirement preparedness on March 15, 2016 to a random sample of Government Executive, Nextgov, and Defense One print and online subscribers. 897 federal employees participated in the survey, including those at the GS/GM 11-15 grade levels and members of the Senior Executive Service (SES). Respondents include representatives from over 30 federal and defense agencies.

Executive Summary

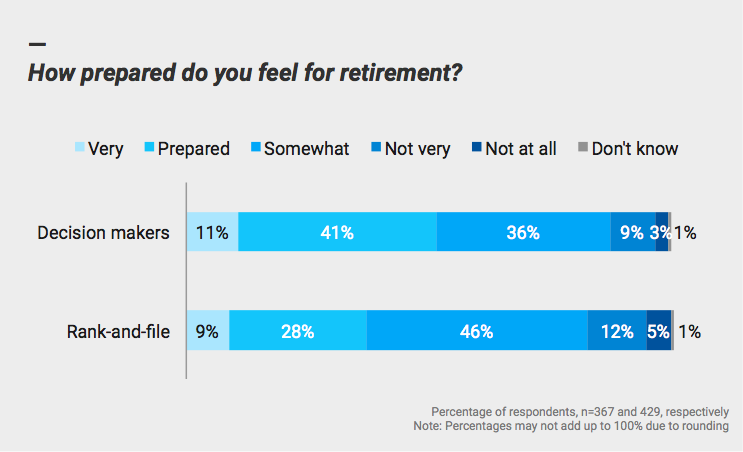

Retirement preparedness varies among federal employees

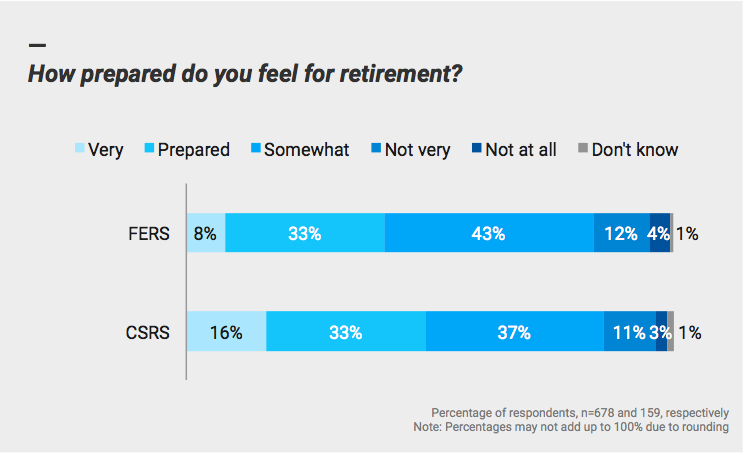

Only 42% of federal employees report feeling prepared or very prepared for retirement, while an equal percentage of respondents feel just somewhat prepared. Confidence also varies depending on pay grade – those at the GS/GM-13 through -15 grade levels and members of the SES feel more prepared for retirement than do employees ranked GS/GM-12 or below. Furthermore, respondents covered by the Federal Employees Retirement System (FERS) are less certain about retirement readiness than their Civil Service Retirement System (CSRS) counterparts, indicating that the expanded investment variables offered by the newer system may result in greater ambivalence with regard to preparedness.

Federal employees face a variety of financial and mental challenges in transitioning to retirement

While a slight majority of respondents indicate that they are prepared or very prepared for the mental implications of retirement – leaving their workplace social network, finding new activities with which to occupy their time, and other emotional factors – many federal employees also report feeling only somewhat prepared. Respondents are even less certain about their ability to adequately cover living expenses: only a slight plurality indicate that they feel prepared or very prepared to navigate the financial realities of retirement, and many identify an array of potential disruptions – changes in health, economic downturn, and other unforeseen events – that could significantly impact their financial readiness.

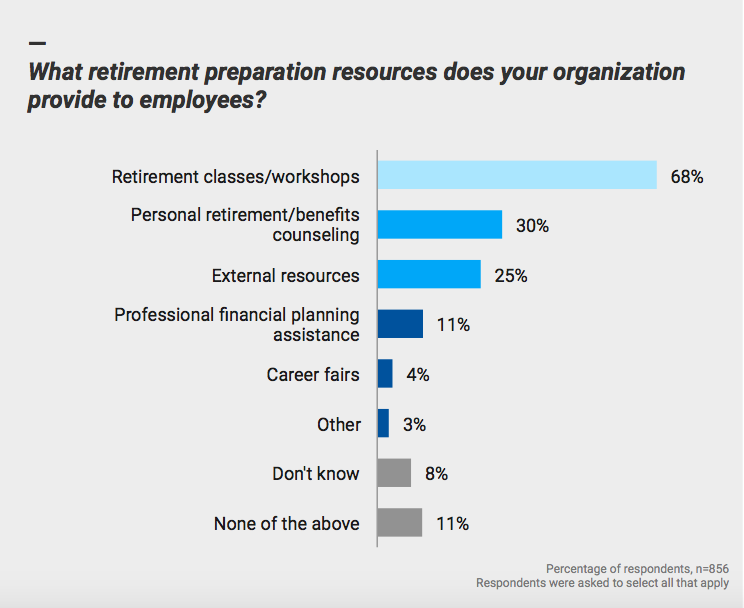

Agency retirement resources have room for improvement

Organization-provided retirement resources receive mixed reviews from federal employees – relatively few report being satisfied or very satisfied with the availability and quality of resources. Furthermore, agencies have yet to expand their range of offered employee resources: while most agencies offer classes or workshops to aid employees with retirement planning, few offer personal counseling, professional financial planning assistance, and other potential resources.

Research Findings

Many federal employees lack confidence in their retirement preparedness

Overall, respondents have mixed feelings with regard to retirement preparedness. Only 42% indicate that they feel prepared or very prepared for retirement, 42% feel somewhat prepared, and 15% are not very or not at all prepared.

.png)

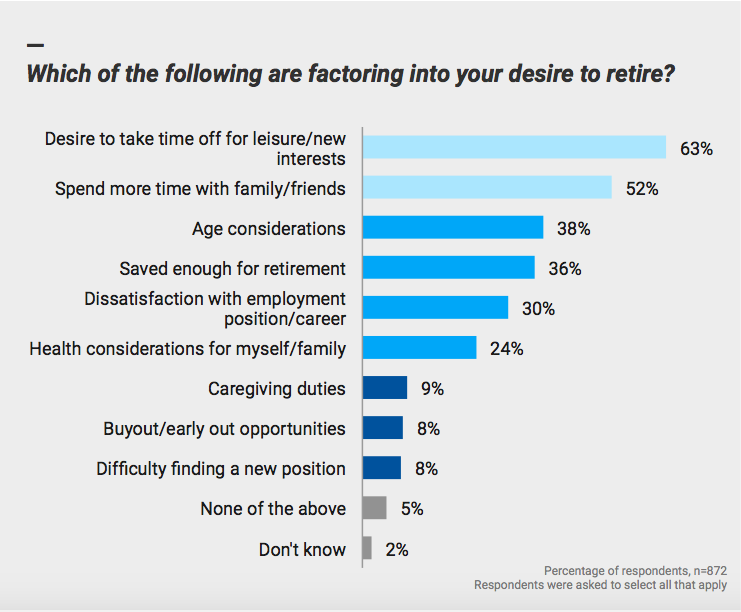

Respondents should continue to prepare themselves both financially and mentally for retirement

Further divergence is apparent when respondents are asked specifically about both financial preparedness (e.g., adequate savings, insurance, etc.) and mental preparedness (e.g., readiness for the life transition, leaving their workplace social network, etc.). A majority of respondents (55%) feel prepared or very prepared for the mental aspects of retirement, 31% feel somewhat prepared, and 13% feel not very or not at all prepared. Results are more mixed when it comes to financial preparedness: 48% are prepared or very prepared, 40% feel somewhat prepared, and 12% are not very or not at all prepared. Ultimately, while respondents feel more ready to navigate the emotional side of retirement, they lack full confidence in both their mental and financial preparation.

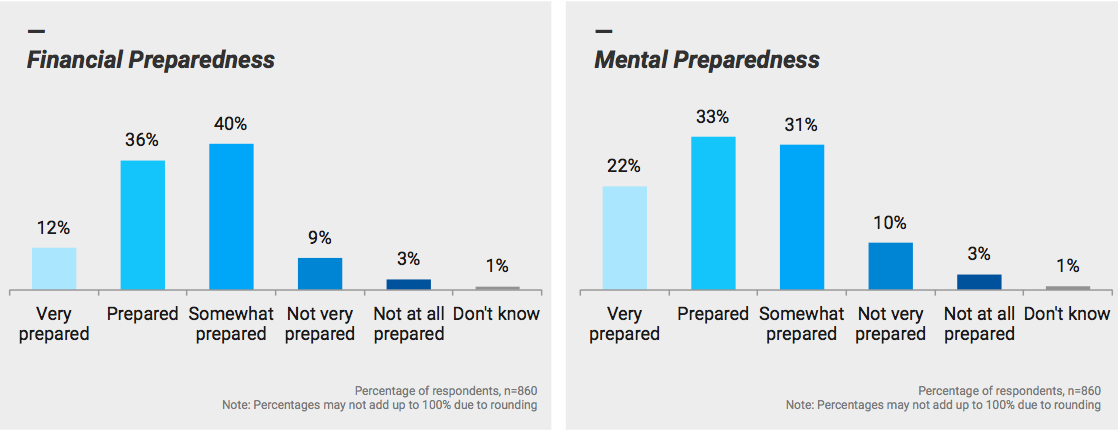

Federal employees have various motivations for retirement

When asked to express their reasons for wanting to retire, respondents most commonly indicate that they would like to take time off for leisure and new interests (63%) and spend more time with family and friends (52%). Other commonly-identified factors include age considerations (38%), feeling that they have saved enough for retirement (36%), dissatisfaction with their employment position or career (30%), and health considerations for themselves or their family members (24%). Some federal employees also feel that they’ve reached a natural end to their careers; as one respondents notes, “I’ve given my time to the federal government, and it’s time for others to take the reins.”

I’ve given my time to the federal government, and it’s time for others to take the reins.Survey Respondent

Financial Preparedness

Federal employees face a host of potential disruptions to financial readiness

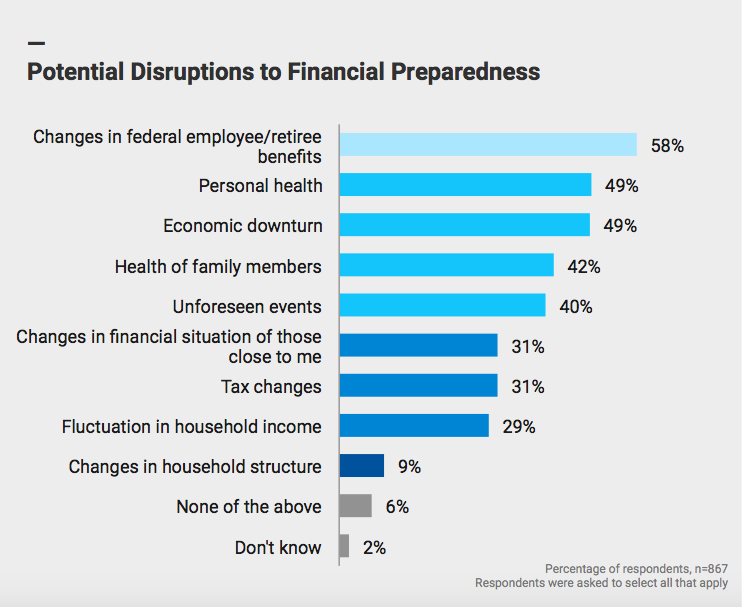

With living expenses skyrocketing, many federal employees poised on the brink of retirement are less financially prepared than they would like to be. When asked to highlight events that might upset their financial preparedness for retirement, respondents most commonly identify changes in federal employee/retiree benefits (58%), changes in personal health (49%), and economic downturn (49%). Other commonly cited concerns include health of family members (42%) and unforeseen events such as natural disasters and drops in home value (40%). Some respondents also express regret over not having contributed more to their Thrift Savings Plan (TSP) and not having saved enough for retirement in general. While unforeseen events can’t be avoided, it is possible to mitigate their disruptive impact by assessing spending habits, estimating necessary retirement income, and taking a proactive stance in establishing a strong financial base.

Many respondents are unsure how federal and private sector benefits compare

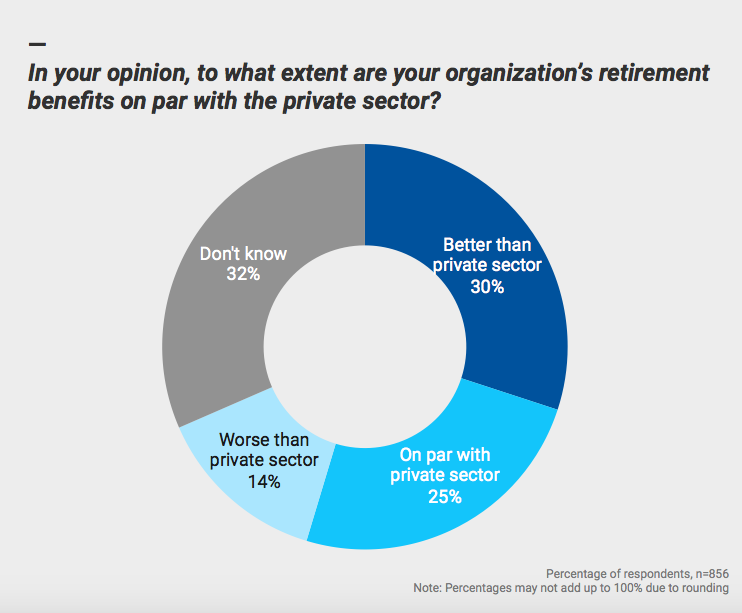

In addition to lacking confidence over financial preparedness, many federal employees are also uncertain about how their retirement benefits compare with those offered in the private sector. When asked to what extent their organization’s benefits are on par with the private sector’s, 30% indicate that their benefits are better than those offered in the private sector, 25% say that they are on par, 14% say that they are worse, and a plurality of 32% say that they don’t know.

Most respondents anticipate being financially independent from their spouse/partner’s income after retiring

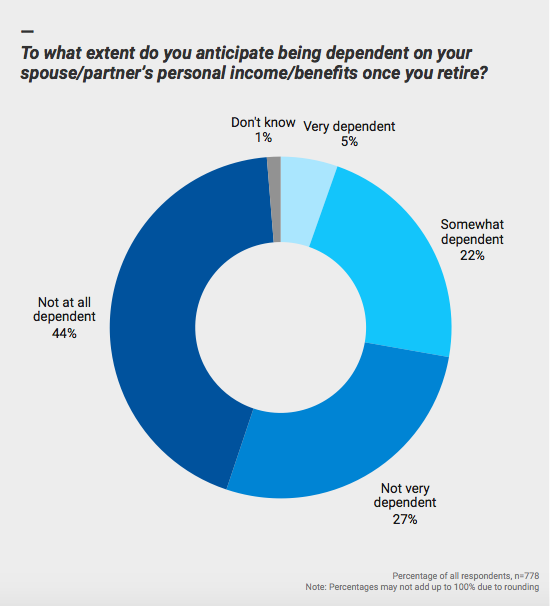

In spite of ambivalence over their financial readiness, a large majority of federal employees do not expect to rely on their spouse or partner’s income after retiring. 71% anticipate being not very or not at all dependent, while only 27% anticipate being very or somewhat dependent.

Mental Preparedness

Respondents face a variety of challenges with regard to mentally transitioning to retirement

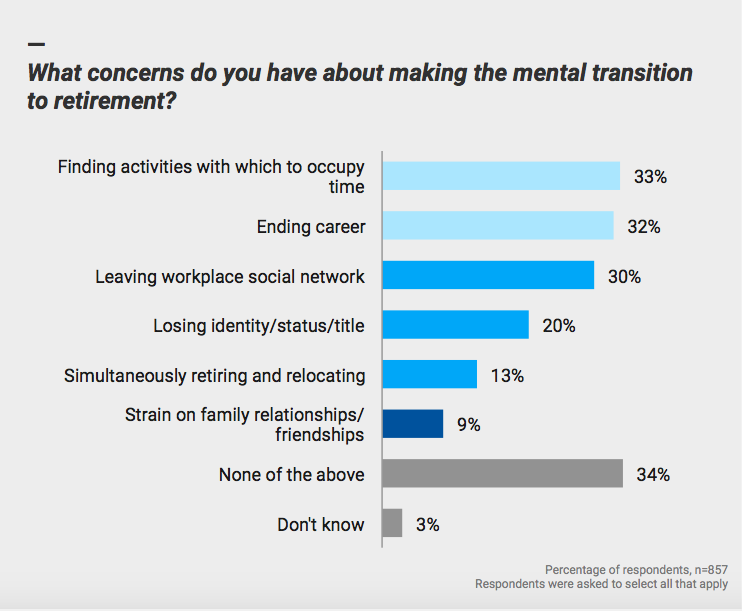

While financial preparation is integral to laying the groundwork for retirement, fewer people consider the emotional challenges of adjusting to a new lifestyle and identity. When asked about concerns they have about making the mental transition to retirement, federal employees most commonly identify finding activities with which to occupy their time (33%) and ending their career (32%). Other concerns include leaving their workplace social network (30%); losing their identity, status, or title (20%); simultaneously retiring and relocating (13%); and straining family relationships and friendships (9%). However, fewer respondents cite mental concerns than financial concerns, suggesting that federal employees may not have given as much thought to the emotional aspects of retiring.

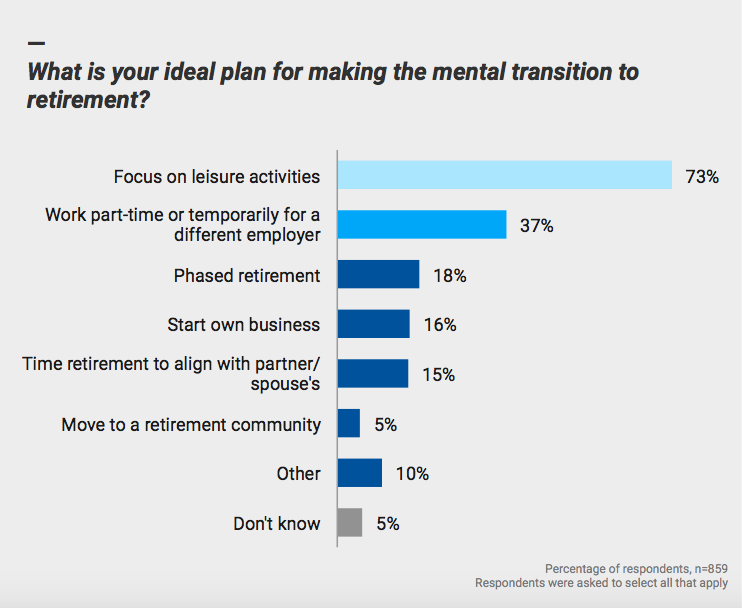

Most respondents plan to focus on leisure activities during retirement

When asked about their ideal plan for making the mental transition to retirement, the vast majority of federal employees (73%) say that they plan to focus on leisure activities such as family, hobbies, and travel after retiring. Respondents also say that they would like to work part-time or temporarily for a different employer (37%) or undergo phased retirement by working part-time for the same organization (18%). However, many individuals dedicated to their careers have yet to fully consider their plans for retirement. As one respondent notes, “I’m well-respected by my bosses and like my job, but because so many people ask me how soon I plan to retire, I feel that I should.” For these people, moving from the workplace to retired life can bring a host of unforeseen challenges. Taking the time to reflect on these changes can help mentally prepare employees to navigate the realities of retired life.

I’m well-respected by my bosses and like my job, but because so many people ask me how soon I plan to retire, I feel that I should.Survey Respondent

Agency Resources

Agencies have yet to expand their range of retirement resources

Faced with a host of financial and mental hurdles, many federal employees depend on organization-offered resources for retirement preparation. However, federal employees indicate that agencies may not make resources as widely available as would be ideal. When asked to identify retirement preparation resources their agency provides to employees, a majority of respondents (68%) identify retirement classes and workshops. However, far fewer respondents say that their agency offers personal retirement and benefits counseling, external resources such as retirement or benefits guides, professional financial planning assistance, and career fairs.

Agency retirement resources still have room for improvement

Federal employees are split on both the availability and quality of agency-provided resources. When asked how satisfied they are with the availability of resources, 29% of respondents indicate that they are satisfied or very satisfied, 29% are somewhat satisfied, and 34% are not very or not at all satisfied. They also have mixed feelings about the quality of their agency’s resources: 34% are satisfied or very satisfied, 27% are somewhat satisfied, and 28% are not very or not at all satisfied. Organization-provided retirement resources and counseling go a long way toward easing employee concerns and smoothing the transition away from the workplace; however, in light of inadequate or unavailable resources, many are forced to maneuver the path toward retirement without external support.

Looking Ahead

Federal employees should continue to prepare themselves for the financial and mental aspects of retirement

Many federal employees on the brink of retirement report feeling less financially prepared than they would like to be. With living expenses skyrocketing, it is more important than ever that federal employees calculate the costs associated with retirement – including potentially disruptive factors such as economic downturns and medical needs – and formulate a concrete strategy for accommodating these costs. Furthermore, federal employees should also devote adequate consideration to the psychological aspects of retiring: while many focus on bolstering their financial portfolio, it is equally crucial that individuals plan for the new lifestyle and identity that comes with transitioning to retirement.

Agencies might consider further prioritizing employee retirement resources

Confronted with a multitude of financial and mental considerations, many individuals are unsure of how to approach the subject of retirement. Employers can be an essential bridge in this life transition – agency resources such as personal counseling and financial planning assistance can help federal employees evaluate their financial situation and benefits as well as guide them through the emotional considerations of retirement. Moving forward, agencies might focus on expanding both the availability and variety of retirement planning resources as well as gauge employee satisfaction with the quality of existing resources.

Respondent Profile

Most survey respondents are currently married and planning to retire in the next 5 to 15 years

.png)

93% of respondents are planning to retire in the next 5 to 15 years.

.png)

71% of respondents are married.

Survey respondents are largely senior federal leaders

.png)

“Other” includes those employed under other pay scales or ranking systems (e.g., Military, Foreign Service, Federal Wage System, Executive Schedule, etc.).

.png)

48% of respondents are supervisors who oversee at least one employee, either directly or through direct reports.

Respondents represent a wide range of job functions and federal agencies

.png)

Respondents were asked to choose which single response best describes their primary job function.

.png)

Departments and agencies are listed in order of frequency.

About Government Business Council

As Government Executive Media Group's research division, Government Business Council (GBC) is dedicated to advancing the business of government through analysis, insight, and analytical independence. An extension of Government Executive's 40 years of exemplary editorial standards and commitment to the highest ethical values, GBC studies influential decision makers from across the federal government to produce intelligence-based research and analysis.

Report author: Rina Li

Underwritten by: LTC Partners

LTC Partners, a versatile benefits administrative services company, currently administers two major contracts regulated by the U.S. Office of Personnel Management — The Federal Long Term Care Insurance Program (FLTCIP) and BENEFEDS. The FLTCIP is the largest group, employer-sponsored long term care insurance program in the country and has more than 274,000 enrollees. www.LTCFEDS.com