The Final Countdown: Filing the Papers

It’s that time of year, when many people are filling out the paperwork to apply for retirement.

We’ve reached the time of year when many federal employees turn in their applications for an end-of-the-year retirement. One reason so many people retire at the end of the year is to get a large lump-sum payment for accumulated annual leave.

Retiring at the end of the year allows employees to stockpile a year’s worth of annual leave hours in addition to what they carried over from the previous year. Employees who retire on Dec. 31, 2017, Jan. 3, 2018, or Jan. 6, 2018, with more than 15 years of service, can accumulate 25 or 26 accruals of eight hours of annual leave (200-208 hours) in 2017 in addition to the 240 hours that they may have carried over from 2016.

If you’re among the people (and there are more than a few of them) who have saved up this much annual leave prior to retirement, you must really be looking forward to some time off. You will receive your lump-sum payment for unused leave from your agency payroll office a few pay periods following your retirement, usually within six weeks of your separation. There will be withholdings for federal, state, FICA, and Medicare taxes, as applicable.

Of course, annual leave accruals are just one factor in deciding exactly when to retire. To learn more about choosing the optimal date for you, check out my annual Best Dates to Retire column.

If you are employed at a large agency, you may want to submit your retirement papers (and they are still paper) at least 90 days ahead of your planned retirement date. For small agencies, 30 days is generally adequate. The Office of Personnel Management will not accept corrections (such as scratch-outs or white-outs) on retirement forms. So be careful in filling them out.

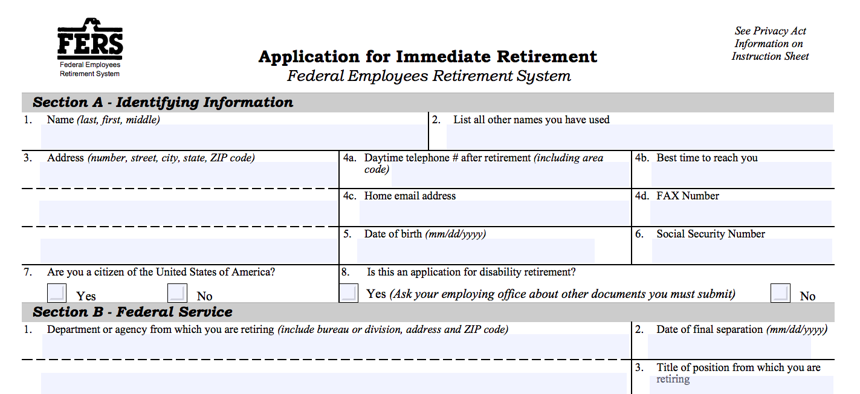

In order to retire from federal service, you will need to complete either the FERS Application for Immediate Retirement or the CSRS Application for Immediate Retirement. If you have Federal Employee’s Group Life Insurance, you will also need to complete the FEGLI Continuation of Life Insurance Application.

This may go without saying, but be sure to keep copies of all of the retirement forms you turn in to your human resources office. In addition, make copies of items in your electronic Official Personnel Folder before you separate from federal service. You will no longer be able to access your eOPF after you’ve been separated more than 30 days.

Important documents to maintain include:

- SF 50 (Notification of Personnel Action) forms documenting important dates. These include your entry into federal service, separation from federal service, reinstatement into federal service, changes in your work schedule, changes in your retirement coverage, periods of leave without pay, and salary rate changes during your high-three average salary period (generally the last three years of your career).

- Beneficiary designation forms for FERS and FEGLI. (CSRS beneficiary forms are filed with OPM, and Thrift Savings Plan beneficiary forms are on file with the TSP.)

- Insurance forms for FEGLI (SF 2817) and the Federal Employees Health benefits Program (SF 2809).

- Any other records that could affect your length of creditable service.

- Any documents that may help with applying for future employment, such as training certificates and performance awards.

In my next column, we’ll look at some of the other documents you may need to include in your application, depending on your individual circumstances.