Federal employees should take some time to think about whether their current health plan is still the best one for next year. Martin Barraud / Getty Images

An Open Season Checklist for Federal Employees

With the largest premium increase in the last 10 years, federal employees should consider whether their existing health insurance plan is still the best fit.

It’s open season for the Federal Employees Health Benefits Program, and participants have until December 12 to choose a health plan for 2023. The employee share of premiums will increase an average of 8.7% next year, the biggest jump in 10 years, which makes this year better than most for employees to consider switching FEHB plans.

Even if you don’t want to make a switch, you should confirm your plan is still best for your family’s needs. This Open Season checklist will guide you through the process.

Big Premium Increases

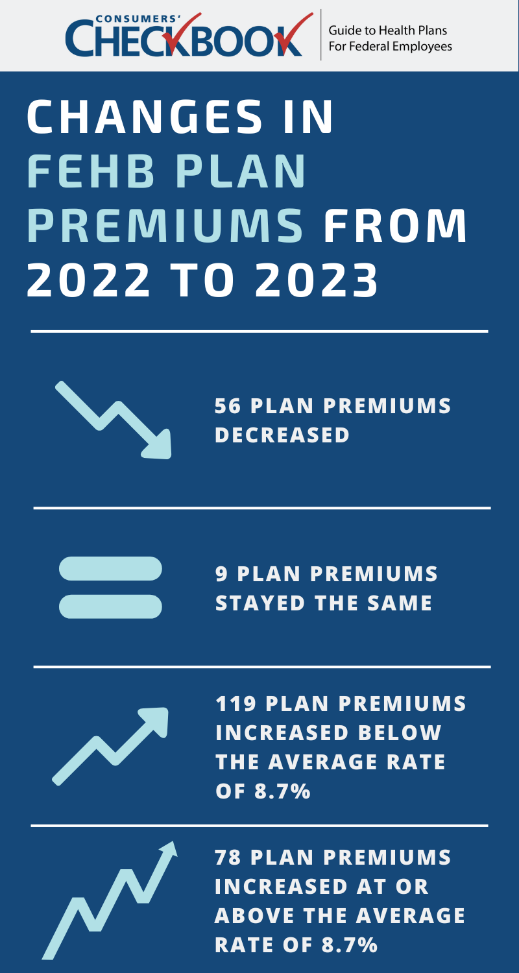

On average, the enrollee share of premiums will increase 8.7% in 2023, but this doesn’t apply to every plan. Next year, premiums will decrease in 56 plans, stay the same in nine plans, increase below the average in 119 plans, and increase at or above the average in 78 plans.

Here are a few examples that show how widely the premium changes can vary: A Nevada plan’s premium is decreasing 36.5%, a plan in New Mexico is raising premiums 49.5%, and a plan in Illinois is raising premiums 34.2%, which will cost self-only enrollees an extra $6,510 for the year.

It’s important to see how your FEHB plan’s premium changed. Even if you’re satisfied with your existing coverage, there might be a better bargain available. While we don’t recommend selecting an FEHB plan based on premium alone, it’s a for-sure expense that should factor into your decision.

Shopping for a New Plan

Total cost is a better approach when selecting a new plan. It’s the combination of for-sure expenses (premiums) and likely out-of-pocket costs you’ll face based your family’s age, size, and expected health care usage.

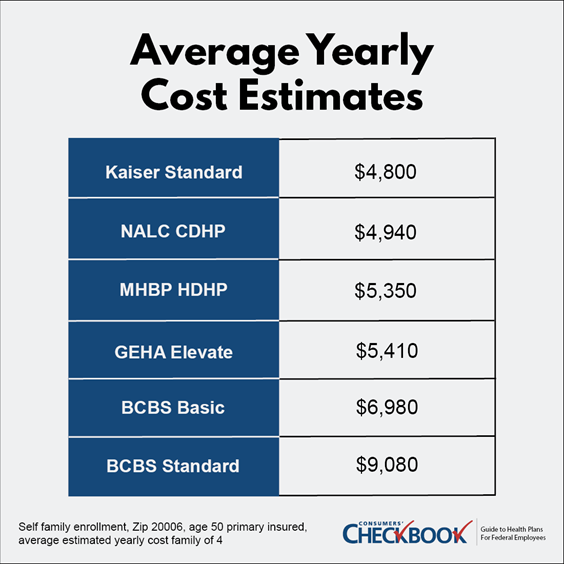

Checkbook’s Guide to Health Plans ranks plan options based on total cost estimates, and there are big differences in 2023. For the sample six FEHB Washington, D.C.-area plans below, a family of four could save $4,280 in estimated total costs by switching from BCBS Standard to Kaiser Standard. If the same family didn’t want to switch to an HMO, they could keep PPO coverage and save $3,760 by switching from BCBS Standard to GEHA Elevate.

Depending on your current plan, where you live, and your eligibility to join restricted plans, the amount you could save will vary. But if you haven’t looked in a few years, take time to see if there’s an option that can offer you better value than your existing plan. Most federal employees can save a thousand dollars or more switching to a lower cost plan.

Flexible Spending Accounts

Only 20% of federal employees participate in a program that guarantees savings on out-of-pocket health care expenses. Flexible spending accounts (FSAs) allow employees to contribute as little as $100 per year and as much as $3,050 a year in 2023. The money you set aside is taken from your paycheck pre-tax in equal installments throughout the year. By avoiding payroll taxes on FSA contributions, you see a savings of about 30% for qualified health care expenses.

There are many FSA-eligible health care expenses you might not be aware of. The CARES Act passed during the COVID-19 pandemic brought back over-the-counter items such as allergy and pain relief medications as qualified expenses. Previously, such items needed a prescription from a doctor to be FSA eligible.

Everyone has some predictable health care expenses in the upcoming year like dental and vision care, known prescription drug medications, and doctor co-pays. Keep in mind that your budget doesn’t have to be perfect. Up to $610 in unused funds in a given plan year will roll over to the next plan year if you stay enrolled in the FSA program.

This a no-brainer way to save money next year on health care expenses.

Plan Benefit Changes

The FEHB plan you had in 2022 might not be the same in 2023. The best place to look for changes is in Section II of the official FEHB plan brochure under “How Your Plan Will Change in 2023.”

You might find that your plan, or a plan you’re considering, is adding new benefits. For example, all Aetna plans added acupuncture coverage in 2023. A handful of plans added infertility coverage for assisted reproductive technologies, including the Indiana University Health Plan with a $20,000 per year infertility benefit, UPMC Standard with a $25,000 lifetime infertility benefit, and Foreign Service with a $5,000 per year infertility benefit.

You’ll also find some benefits will cost more. For example, the out-of-network catastrophic limit in the United HDHP plan is almost doubling next year from $6,850 per year for self only coverage to $12,000 per year.

Make sure you check your plan’s brochure and any plan you’re considering so you don’t experience any unwelcome surprises in 2023.

Provider Directory and Formulary Updates

It’s possible for a doctor to leave a plan network at any time during the year. Likewise, a prescription drug could be removed from a plan formulary at any time. We recommend checking to make sure your current doctor(s) are still planning to participate next year. You’ll always pay less by staying in-network, and some FEHB plans don’t provide out-of-network coverage.

Most FEHB plans maintain updated online provider directories and prescription drug formulary lookups. Check the plan website or call your existing doctor(s) to confirm plan participation in 2023.

Dental and Vision Care

Standalone Federal Employee Dental and Vision Insurance Program plan premiums will mostly stay unchanged in 2023, with dental plan premiums increasing an average of 0.21%, and vision plan premiums decreasing an average of 0.41%. And new for 2023, there are no longer any orthodontic waiting periods with any of the FEDVIP dental plans.

Before considering joining a FEDVIP plan, consider how much dental care you’ll need in the upcoming year and what dental coverage your FEHB plan might provide. Enrolling in a FEDVIP plan becomes a wise financial decision when you anticipate average to high dental care costs next year. If you anticipate fewer expenses, there are several FEHB plans that offer free or low-cost preventative care either as an official FEHB benefit or as part of an unofficial benefit. These unofficial dental savings programs, if available, can be found in in the non-FEHB benefit section of the official FEHB plan brochure.

Keep in mind that dental coverage provided by a FEDVIP plan or FEHB plan will have provider restrictions. Before joining any plan, make sure you check that your current dentist will be in-network.

The Final Word

Less than 2.5% of federal employees change their health plan during Open Season. With the largest premium increase in the last 10 years, more federal employees should consider whether their existing FEHB plan is still the best fit.

Even if you aren’t considering switching plans, you should check key details like benefits, provider network, and prescription drug coverage to confirm your existing plan hasn’t materially changed in 2023.

Finally, take advantage of easy ways to save money. All federal employees should have an FSA to save on out-of-pocket health care costs. For employees that haven’t done so before, start out with a couple hundred dollars. There is no risk of losing those funds with the roll-over allowance.

The FEHB, FEDVIP, and FSA Open Season starts November 14 and ends December 12.

Kevin Moss is a senior editor with Consumers’ Checkbook. Checkbook’s "2023 Guide to Health Plans for Federal Employees" is available to many federal employees for free. Check here to see if your agency provides access. The Guide is also available for purchase and Government Executive readers can save 20% by entering the promo code GOVEXEC at checkout.