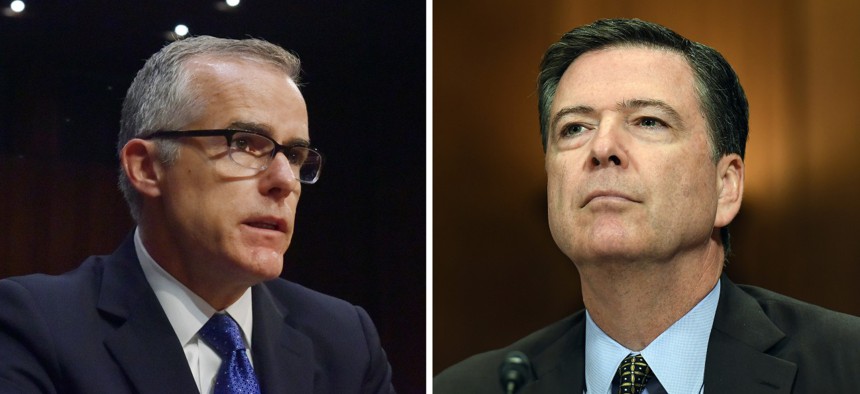

Trump foes Andrew McCabe, left, and James Comey were picked for rare IRS audits. Jahi Chikwendiu/The Washington Post via Getty Images and Matt McClain/The Washington Post via Getty Images

Professional Groups Are Rallying Around the IRS Workforce After Revelations That Trump Foes Were Selected for Rare, Intensive Audits

One says it has faith in the “vast majority” of IRS career civil servants to avoid political interference.

Employee groups have come to the defense of the Internal Revenue Service workforce following the news that two former senior government officials who were both foes of President Trump were selected for rare and intensive tax audits.

The New York Times reported on July 6 that former FBI Director James Comey and his deputy Andrew McCabe were selected for the rare audits. Agency officials said both were chosen randomly and that Commissioner Charles Rettig had no improper involvement, but Comey and McCabe were both targets of former President Trump, leading some to question whether their selection may have been intentional. Rettig has asked the agency’s watchdog to look into the matter, the Times reported.

The Professional Managers Association, which represents management officials and non-bargaining unit employees in the federal government and within the IRS, “is confident the vast majority of Internal Revenue Service employees uphold their oath to faithfully and impartially serve the American people,” said Chad Hooper, PMA executive director, in a statement on Wednesday. If there is found to have been political interference or bias in the selection process, then the association would encourage the IRS to take necessary action, he said, but “much is still unknown, and we caution lawmakers and the media not to undermine public trust in our tax system based on unfounded assumptions or partial information.”

The Times reported, “how taxpayers get selected for the program of intensive audits—known as the National Research Program—is closely held. The IRS is prohibited by law from discussing specific cases, further walling off from scrutiny the type of audit Mr. Comey and Mr. McCabe faced.”

Hooper did bring forward a possible explanation for what happened.

“Tax returns are subject to a statistical assessment. Anomalous tax returns are flagged for possible audit,” so it wasn’t “surprising” that Comey and McCabe’s tax returns were flagged as such, he stated. Both spent years in federal service then published high-grossing books after their departure, so “both individuals’ tax returns likely changed dramatically in a short period of time, making those returns appear unusual.”

When IRS managers are notified about an anomalous return from a “controversial political figure” they are “left between a rock and a hard place where either way there may be a perception of bias,” Hooper added.

Tony Reardon, national president of the National Treasury Employees Union said, “the IRS continues to face major challenges of funding, staffing and modernization, all of which require the full attention of Congress,” when asked for comment on the situation and what it means for the IRS workforce writ large.

The IRS employees that NTEU represents “remain focused on the work they are assigned to accomplish [and] the agency’s important missions of providing quality customer service to taxpayers, administering the tax code fully and fairly, and collecting the revenue that funds the government,” Reardon said. “IRS employees welcome reviews of systems designed to ensure the strong integrity of the IRS, so that lawmakers may confidently provide appropriate funding to the IRS.” He also reiterated the union's call for lawmakers to provide a sustained funding increase for the agency so it can better fulfill its missions.

In addition to the IRS commissioner, Rep. Richard Neal, D-Mass., chairman of the House Ways and Means Committee, asked the Treasury Inspector General for Tax Administration to open an investigation following the Times report. “I am very concerned about the impact on public confidence resulting from allegations that the IRS has been used to exact revenge on political enemies,” Neal wrote in a letter on July 7. “These allegations are reminiscent of another time when a president inappropriately used the IRS to target his enemies,” he said, referring to President Nixon.

Rep. Kevin Brady, R-Texas, ranking member on the committee, said in a statement, “Commissioner Rettig has stated unequivocally he has had no communication with President Trump, and the research audits are statistically generated.” Brady also said he supports investigating allegations of political interference at the agency, which he says is consistent with his committee’s precedent when it investigated allegations of political targeting by the IRS during the Obama administration. (The Justice Department ultimately declined to prosecute any IRS officials in that case).

The House Ways and Means Committee met with Rettig behind closed doors on Thursday to discuss the audits, the committee tweeted. He will also meet with a group of senators behind closed doors on July 26, according to NPR.

Rep. Bill Pascrell Jr., D-N.J., who serves on the House Ways and Means Committee, called for President Biden to fire Rettig in a letter to the president on July 8.

“Mr. Rettig’s tenure at the IRS has been marked by deteriorating taxpayer services, careless document destruction, and near-nonexistent scrutiny of wealthy tax scofflaws,” wrote the congressman. “The revelation that the IRS under Mr. Rettig’s leadership may have been used as a political weapon by Donald Trump must be the final straw.” Pascrell has previously called for the commissioner’s firing.

John Koskinen, who served as IRS commissioner from December 2013 to November 2017, told Government Executive that if he were still commissioner, he would also ask the watchdog to investigate. Since both Comey and McCabe were fired during the Trump administration and Trump “made no secret of his hatred of them, it's an important discussion to have,” Koskinen said; however, it “would be almost impossible to pull this off as a purposeful act,” he said.

Koskinen also stated, “I have a lot of confidence in the IRS workforce, who are a very dedicated group and they all are reminded through a course each year that it is a criminal violation just to look at someone's return without authorization, let alone do something with it.”

Mark Everson, who served as IRS commissioner from May 2003 to 2007 and is now vice chairman at the alliantgroup, a national tax consulting services firm, said he would be “stunned if the selection of these two individuals was anything other than random,” but still thinks a review is needed to “clear the air.” He added that when he was commissioner, he had “absolute faith in the integrity of the research operation" and his only complaint was that in order to be so thorough it was slow.

During a briefing on July 7, White House Press Secretary Karine Jean-Pierre referred to the IRS for any questions on the audits. When pressed if the president still has confidence in Commissioner Rettig, she said his term is up in November and “he is the commissioner of the IRS, part of the administration.”

The IRS and Treasury Inspector General for Tax Administration did not respond for comment for this story.