filo/Getty Images

Medicare Part D may benefit most federal annuitants next year

COMMENTARY | Not only are there more options to choose from, but there are also benefit changes that may make Part D more convenient and a better value, according to Kevin Moss of Consumers’ Checkbook.

This year, OPM allowed FEHB plans to begin offering Part D coverage to Medicare-eligible enrollees. To be included, the Part D plan must provide prescription drug coverage that, when combined with an existing FEHB plan, is as good or better than what’s available through the FEHB plan alone.

Seventeen FEHB plans offered PDPs to their Medicare members in plan year 2025, and next year, that number will increase to 20. Not only are there more options to choose from, but there are also benefit changes that will make Part D more convenient and a better value. I’ll walk you through the key updates and help you figure out how to determine if Part D is the right fit for your prescription drug coverage.

Note: Starting next year, United States Postal Service annuitants and their covered family members will receive healthcare benefits through the new Postal Service Health Benefits Program. PSHB Part D rules differ from FEHB, so these recommendations do not apply.

Equal or Greater Coverage

The first thing to know is that PDPs (or PDP EGWPs) must provide equal or better drug coverage than what’s offered by the FEHB plan. This includes both the drugs covered and the out-of-pocket costs. From the Office of Personnel Management: “FEHB annuitants enrolled in an EGWP must have formulary access to all drugs covered under the corresponding FEHB formulary at the same or lower cost-share than they would have otherwise been responsible for if they enrolled solely in the FEHB plan.”

Medicare enrollees in FEHB PDPs may have access to drugs not typically found in commercial PDPs. For example, GLP-1 weight loss drugs can only be prescribed to treat conditions like heart disease or diabetes in commercial PDPs, not weight loss. However, OPM requires coverage of at least one GLP-1 weight-loss drug, and that extends to PDPs.

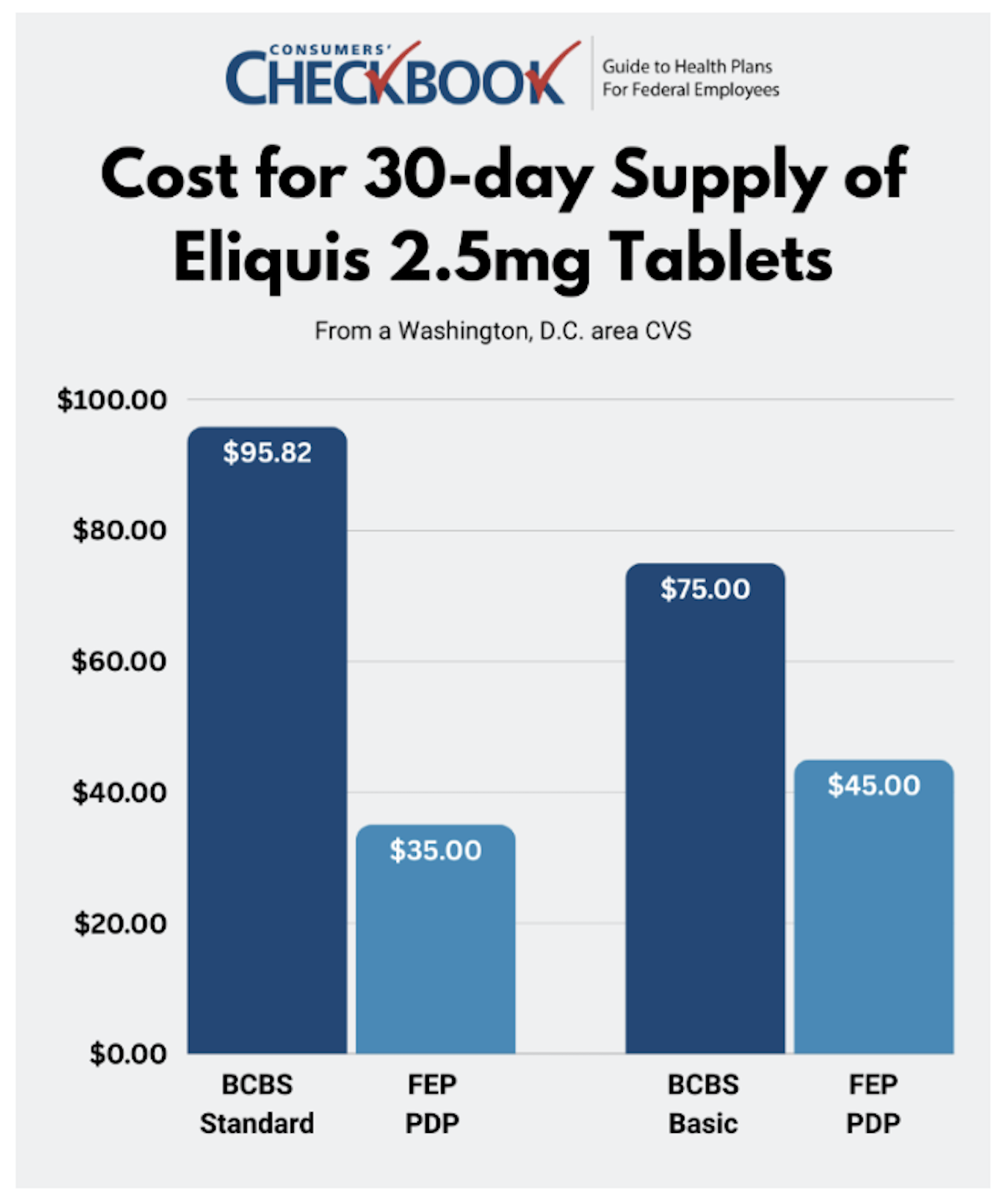

Last year, I spoke with many federal annuitants who disenrolled from Part D because they noticed higher prices for the same drug, dosage, and pharmacy in the PDP compared to their FEHB plan. But this year, it seems like that’s not the case. In fact, I’m seeing significant savings in the PDP plans. To get a better sense of what’s going on, I used the BCBS prescription drug pricing tool and compared prices for one top-selling Part D drug between BCBS plans and the FEP PDP.

OPM has encouraged carriers to implement innovative solutions to help enrollees better understand prescription drug benefits, so comparing coverage between your FEHB plan and the PDP should be easier this year. Make sure you know how your current prescription drugs will be covered by the PDP; you may find, like the example above, that the PDP is providing lower prices than your FEHB plan.

2025 Part D Benefit Changes - $2,000 Max & Payment Plans

Starting next year, all Part D plans will feature a $2,000 annual cap per Medicare enrollee on out-of-pocket prescription drug costs. This new limit offers significant relief to federal annuitants with high prescription drug expenses. However, it’s important to note that FEHB plans vary in how they apply PDP costs towards the medical catastrophic maximum. In some plans, out-of-pocket PDP costs will count towards both the medical and Part D catastrophic limits, while in others these costs will only count towards the Part D limit. Be sure to review your plan’s specific rules to understand how this may affect you.

Medicare is also introducing a new prescription payment plan, which allows enrollees to spread their out-of-pocket costs throughout the calendar year. Enrollment in the payment plan is voluntary, but it could benefit those expecting more than $2,000 in out-of-pocket costs, particularly if they reach the limit early in the year. Medicare provides a website where you can learn more about the payment plan and determine if it’s right for you. Those interested in enrolling should visit their FEHB carrier’s website for details on opting in.

Which FEHB Plans Offer Part D plans

The following 20 FEHB plans will offer PDPs to their Medicare enrollees next year:

Aetna Direct – Consumer Option

Aetna Open Access – High, Basic (Mid-Atlantic)

APWU – High

BCBS – Basic, FEP Blue Focus, Standard

Compass Rose – High

Foreign Service

GEHA – High, Standard (both new for 2025)

HealthPartners – High, Standard

MHBP – Consumer Option, Standard, Value

NALC – CDHP (new for 2025), High

SAMBA – High, Standard

Annuitants in these plans who have either Medicare Part A or Parts A and B will be automatically enrolled in the PDP (note: BCBS only auto-enrolls members who have both Parts A and B). Your FEHB plan will send you a letter confirming your eligibility and automatic PDP enrollment, along with instructions on how to disenroll if you choose.

If you disenrolled from Part D this year, you will not be automatically enrolled next year. If you wish to enroll in Part D for the upcoming year, you will need to contact your plan directly. Annuitants who currently receive prescription drug benefits through a PDP and wish to keep their current FEHB plan do not need to take any action to maintain the same coverage next year.

Reasons to Consider Opting Out of Part D

While most federal annuitants will benefit from Part D coverage, there are a few situations where you may not be better off.

- You’re subject to IRMAA – While PDPs offered by FEHB plans don’t have an additional premium, individual tax filers with income above $106,000 and joint tax filers making more than $212,000 are subject to an Income Related Monthly Adjustment Amount, known as IRMAA. In the first IRMAA tier, this would add $13.70/month to the cost of Part D enrollment. Federal annuitants subject to IRMAA will need to evaluate the potential Part D benefits against the IRMAA surcharge when deciding whether to keep Part D.

- You use pharmaceutical discount coupons - Having Part D disqualifies you from using pharmaceutical manufacturers’ coupons. There is a U.S. anti-kickback statute that makes it illegal for individuals enrolled in Medicare to use drug-discount programs.

If you currently use one, and the value of that discount is worth more than potential Part D benefits, opt out of Part D.

- You spend considerable time overseas - Like Original Medicare, Part D does not provide international coverage. If you live abroad or spend a lot of time overseas, you may opt out of Part D and maintain your FEHB prescription drug coverage.

If you’re just traveling overseas, consider keeping Part D. To help with PDPs’ lack of international coverage, you can obtain travel insurance that pays for medical expenses not covered by your health plan.

The Final Word

Most federal annuitants will benefit from Part D coverage and should keep it. This is especially true next year when all Part D plans will offer a $2,000 maximum out-of-pocket limit, a prescription drug benefit not found in FEHB plans. If you live overseas or heavily use pharmaceutical discount programs, Part D will be of limited value and you’ll likely be better off with the prescription drug coverage from your FEHB plan. Federal annuitants subject to IRMAA will need to determine whether the surcharge outweighs Part D benefits.

Kevin Moss is a senior editor with Consumers’ Checkbook. Watch more of his free advice and check here to see if your agency provides free access. The Guide is also available for purchase and Government Executive readers can save 20% by entering promo code GOVEXEC at checkout.